This week / What’s new? | Why does it matter? | What’s next? | What else? | Quotable | One more thing

This week

Read on to learn why:

① Most investors younger than 45 don't feel the need to meet their adviser in person.

② Your brand is at stake if your digital channels are not on par with traditional ones.

③ Digital channels should feel bespoke and be infused with empathy.

④ Investors with complex needs demand digital channels.

⑤ Investors with simple needs demand digital channels.

⑥ Microsoft’s CEO regards marketing as one of its top drivers of success.

⑦ Financial services marketing needs to be omni-channel.

This week / What’s new? / Why does it matter? | What’s next? | What else? | Quotable | One more thing

What’s new?

Money Marketing reported on Boring Money’s 2021 Advice Report which found that online meetings are now the ‘preferred channel’ for advice.

① In short:

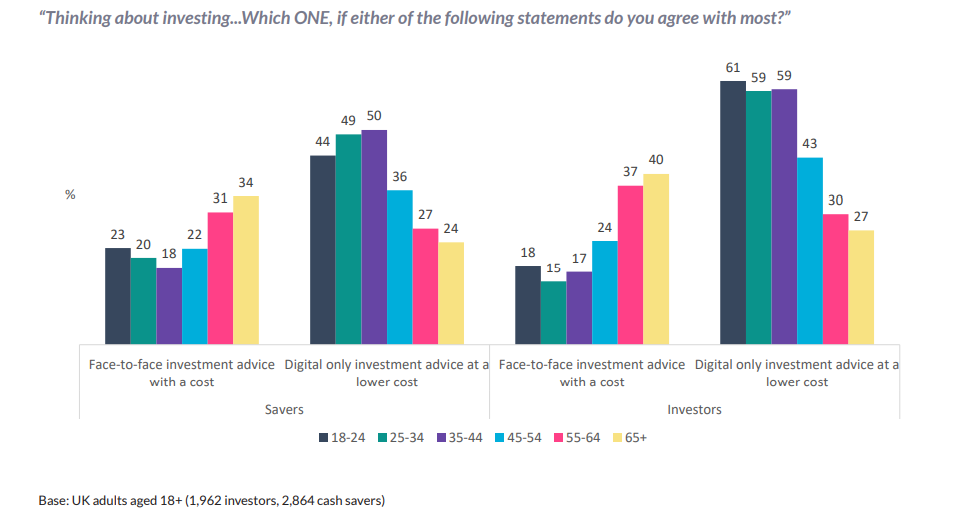

“The report reveals 40% of investors would favour paying a lower fee for digital advice, while 29% said they would prefer face-to-face advice even if it would mean higher fees. Almost half said they were happy to receive advice via video, a 24% increase since 2019.”

“People between the age of 55 and 65 were most likely to stick with face-to-face meetings. In fact, 34% of people aged over 65 said they would rather have a face-to-face meeting even it involves higher cost, while 24% said they are not unhappy with digital advice.”

“Only 13% of younger customers (below 45) felt it is important to meet with an adviser in person.”

This week | What’s new? / Why does it matter? / What’s next? | What else? | Quotable | One more thing

Why does it matter?

This report matters not because it teaches us something new but - like a lot of the other news items in this week’s briefing - because it confirms a trend in financial services that is now undeniable. Firms of all types are gravitating towards wealth management as a source of profit. In doing so, whether it be at the simpler end of the market where fintech apps are democratising it, or at the other end catering to investors with more complex needs, digital channels have emerged as a vital component.

For all but the simplest of wealth management needs, face to face advice delivered by a human specialist is here to stay but it will be complemented by digital experiences. This is partly because commercial pressures such as a growing appetite for fixed fees mean firms need to increase their efficiency but it’s mostly because clients now insist on it. And don’t make the mistake of thinking that it’s just younger clients who demand digital channels - the data shows that it’s less a matter of age and more about sophistication. The more affluent the client, the more they expect a delightful digital experience in additional to human interaction when needed.

② From a marketing perspective, those digital channels are an integral - if not the only - part of your client’s journey. So, they need be on par in terms of quality, messaging and general experience as all your other client touchpoints. To be blunt: your brand is at stake if they’re not.

This week | What’s new? | Why does it matter? / What’s next? / What else? | Quotable | One more thing

What’s next?

Take action

③ This topic isn’t new so let me simply remind you of advice I’ve offered in the past.

Your brand’s good standing depends on every client interaction - and those will increasingly be taking place via digital channels. So, whether it be onboarding, advice via video, or reporting - leverage your marketing team to ensure that each one of those interactions is consistent with everything your brand has been until then, that it's easy and feels like it was designed by humans who want to help.

Infuse empathy into your digital channels. Talk about your clients’ problems, not your solutions; attract, don’t broadcast; show, don’t tell; and track behaviour, not hits.

Provide a bespoke experience online by seeking consent from your clients, delivering real value and relying on collaboration between all client-facing teams.

Get help

I’m currently looking for a full-time, in-house role but in the post-Covid age of depleted marketing budgets and remote teams with skills gaps, many organisations need marketing and communications support that’s agile, flexible, and risk free. That’s why I founded WhatsNext Partners.

Whether it be as a permanent member of your team or with 'on demand' support, let me know if you need my help.

Share with your network

If you found this post useful or know someone who would, please like, comment on, or share it using the buttons below.

This week | What’s new? | Why does it matter? | What’s next? / What else? / Quotable | One more thing

What else?

Three other articles that are worthy of your time.

FINANCE

Banks see wealth management as a growth engine, but they aren’t very good at it

④ Investors with complex needs demand digital channels plus human advice.

“Banks are still so siloed they struggle to identify wealthy individuals, or if they do have a sense, they have trouble handing the clients over from the commercial banks, or from the private bank to the wealth management arm.”

“If a wealth management firm hasn’t built a strong relationship with the woman, who statistically is likely to outlive her husband, the firm will see the money shift to another firm and another advisor.”

“Firms, especially in banking, are scaling a lot through digital, so advisors can service more clients, or some clients can be served through a shared pool that is more digitally led. Firms and advisors are seeing a growing proportion of clients who want to do some of the work themselves — from onboarding to looking at their transactions.”

TECHNOLOGY

How technology is helping to bring investing to the masses

⑤ Investors with simple needs demand digital channels and plenty of firms provide.

“The past 12 months have seen a massive surge in people investing for the first time with robo-advisers, platforms and digital disruptors all vying for their business.”

“Dozens of new names have sprung up in this market, many of them minnows compared to the traditional players. Even Nutmeg, which claims to be the largest digital wealth manager, has just 100,000 customers; compare that to the 4 billion logins to Lloyds Bank’s digital banking services in 2019.”

“While some investors, especially those with big wallets, still prefer the experience and emotional intelligence of a human adviser, technology is proving it can compete and help widen access to money management whether through investing or saving.”

MEDIA & MARKETING

Cannes Lions names Microsoft its 2021 Creative Marketer of the Year

⑥ Microsoft’s CEO values marketing as one of its top drivers of success.

“The annual honor goes to an advertiser that has consistently produced creative and Lion-winning work over the years. Microsoft has repeatedly impressed at the festival, earning accolades across its suite of products.”

“In 2019, for example, the brand had a particularly standout showing with its “Changing the Game” campaign, created out of McCann New York. The effort centered on the company’s accessible gaming controller and earned both a Grand Prix in Brand Experience and Activation as well as a Titanium Lion, among other honors.”

“CEO Satya Nadella has stated that ‘marketing is one of the top drivers of our success’.”

This week | What’s new? | Why does it matter? | What’s next? | What else? / Quotable / One more thing

Quotable

⑦ Leanne Fremar, chief brand officer, JPMorgan Chase, speaking to Ad Age's Jeanine Poggi during a live interview this week:

“People love the personal relationship [of visiting branches]. But people also love the flexibility, convenience, security, and the deep features and insights that come with our app. So people engage there on things they might not necessarily engage with in a branch. It’s about a multi-pronged approach. Everything has relevance and importance in the mind of certain consumers.”

This week | What’s new? | Why does it matter? | What’s next? | What else? | Quotable / One more thing

One more thing…

You’ve likely already seen the Bloomberg profile of Pictet that’s been doing the rounds this week but, just in case you missed it, I couldn’t resist bringing you some highlights.

“In its entire history, only 43 individuals — all men, all white — have risen to the rank of Pictet managing partner, creating a bond more enduring than your typical marriage. From their Geneva perch, they oversee more than 600 billion francs ($662 billion) in assets under management and a level of profitability far beyond larger, publicly-listed peers, often rewarding each of them with more than 20 million francs a year. […]

“Up until a few years ago, the firm was so old-fashioned that managing partners were expected to be addressed as Notre Sieur, a formal French title for sire.”

“Former managing partner Nicolas Pictet once told his employees that retaining a client was more important than making a profit.”

Off cuts

The stories that almost made this week’s newsletter:

🏢 Monday: US and Europe split on bringing bankers back to the office

👨🏻💻 Monday: Digital dominates wealth sales for HSBC

🏦 Wednesday: Facebook-backed digital currency project narrows focus to US

🌏 Wednesday: HSBC on track to hire 1,000 wealth managers in Asia before year end

🤑 Wednesday: Tesla stops taking Bitcoin, citing environmental harm

🇭🇰 Thursday: Citi eyes 1,000 wealth hires in Hong Kong over next five years