This week / What’s new? | Why does it matter? | What’s next? | What else? | Quotable | One more thing

This week

I noticed after last week’s ESG-themed issue went out that the UK finance sector is responsible for more carbon emissions than Germany. Ouch. More progress needed.

Back to this week. Read on to learn why:

① No one ever made a decision because of a number. They need a story.

② A story pulls you in, engages you and dramatically increases your retention.

③ Your communications should be tangible and relatable.

④ Not even Goldman Sachs can swim in China’s vast pool of savings alone.

⑤ The Clubhouse model is better suited to trading apps.

⑥ Seth Godin is still right: Content marketing is the only marketing left.

⑦ Young investors feel the odds of taking part and winning are stacked against them.

This week / What’s new? / Why does it matter? | What’s next? | What else? | Quotable | One more thing

What’s new?

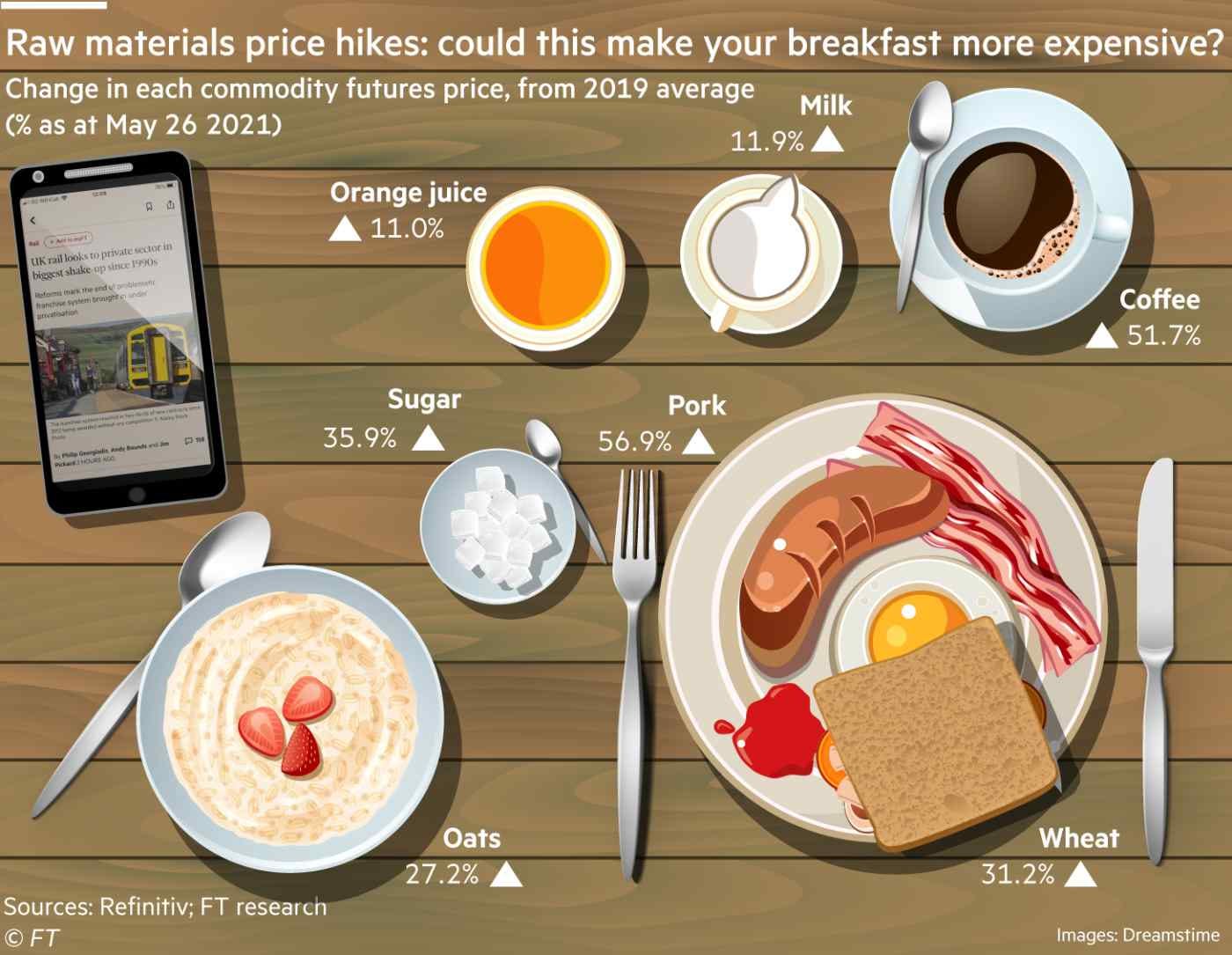

On Friday, the FT carried a story about the investment community’s topic du jour: inflation. They illustrated it using that most sacred of institutions, the British breakfast.

In short:

“The cost of raw materials that go into making breakfast staples have roared higher since the pandemic began — raising fears that a broad commodity boom could push up global food prices for consumers.”

“The cost of raw ingredients accounts for only part of the overall price paid for products at the supermarket or in restaurants, but substantial cost rises were likely to be passed on to consumers, said analysts.”

“In developing countries, where food is less processed and the portion of disposable income spent on staples tends to be higher, the rise in agricultural commodity prices will be felt much more. It will be most acute for those living in extreme poverty, a group that has swelled by an estimated 90m people during the pandemic, according to the World Bank, rising significantly for the first time in two decades.”

This week | What’s new? / Why does it matter? / What’s next? | What else? | Quotable | One more thing

Why does it matter?

You might think that an article of detailed analysis of inflationary pressures in the agricultural sector - one that includes a chart comparing rebased futures prices - isn’t an ideal starting point for us to discuss marketing. I’d argue otherwise though because, in fact, that’s the sort of complex topic that a lot of us in the finance sector have to tackle on a daily basis. This article matters because it shows us how to do so in compelling fashion.

① By leading with a picture of a breakfast, something everyone relates to, and using it as a simile for agricultural prices, the FT draws the reader in and vastly increases the chances of its article being read by its intended audience. It knows that Daniel Kahneman, the 2002 Nobel Prize winner in Economic Sciences, was right when he said:

“No one ever made a decision because of a number. They need a story.”

② This is what far too much marketing in our sector seems to forgo: the audience wants a narrative. As a reader, a story pulls you in, engages you and dramatically increases your retention. It also makes you far more likely to share the content afterwards.

This week | What’s new? | Why does it matter? / What’s next? / What else? | Quotable | One more thing

What’s next?

Take action

Have a good hard look at your existing marketing. Be critical. Chances are it’s full of acronyms and industry jargon. Most likely, it jumps straight into descriptions of features or technical detail. Can you see the wood for the trees? More importantly, can your audience?

③ Your head of marketing should be making your communications tangible and relatable. There are three things to bear in mind:

Ask ‘So what?’: That question may be the most powerful in marketing. By asking it often enough, you eventually uncover the true benefit of the most sophisticated of product offerings, in order to tell customers the simple story behind often complex solutions.

Paint a picture: This is your hook, the thing that will catch your audience’s eye and make them curious about engaging with your content. If you can, yes, literally draw a picture. As the cliché goes, it’s worth a thousand words. But pictures can be painted with words. Or sounds. Or video. The point is to make your story as vivid as you can, to bring it to life.

Don’t dumb down: Making it real does not mean dumbing it down. The FT article is a characteristically detailed look at a subsection of inflationary forces. It’s intended for those with a deep interest in financial markets. By using a picture and a simile, the FT isn’t short-changing their audience but they are maximising the percentage of that audience that will notice and read the piece.

Get help

I’m looking for a full-time, in-house role but in the post-Covid age of depleted marketing budgets and remote teams with skills gaps, many organisations need marketing and communications support that’s agile, flexible, and risk free. That’s why I founded WhatsNext Partners.

Whether it be as a permanent member of your team or with 'on demand' support, let me know if you need my help.

Share with your network

If you found this post useful or know someone who would, please like, comment on, or share it using the buttons below.

This week | What’s new? | Why does it matter? | What’s next? / What else? / Quotable | One more thing

What else?

Three other articles that are worthy of your time.

FINANCE

Goldman wins approval for wealth management deal in China

④ Not even the Sachs of Gold can swim in China’s vast pool of savings alone. Much as they’d love to.

“Goldman Sachs has won initial approval from Chinese regulatory authorities for a wealth management joint venture with ICBC, one of China’s largest banks. It will hold a 51 per cent stake in the venture, while ICBC will own the rest.”

“Foreign asset managers are rushing to capitalise on China’s vast pool of savings as the government liberalises its tightly controlled financial system.”

“Wealth management products in China are typically distributed through the domestic banking network, pushing foreign asset managers into partnerships with local banks.”

TECHNOLOGY

Robinhood competitor Public is launching in-app live audio programming

⑤ The Clubhouse model has arrived in trading apps - where it makes a far more compelling case for itself.

“Public, the trading and social networking app, is the next app to get into live audio. Unlike its competitors, like Clubhouse and Twitter Spaces, however, Public will initially program these chats with moderators it pays, meaning not just anyone can start a conversation.”

“Topics might include coverage of an upcoming IPO, the day’s news, or analysis.”

“Clubhouse and other apps might host chats with randos who claim to understand the stock market and Bitcoin, but [Public] are betting people are more interested in formal live programming that it can guarantee will be well-moderated and from trusted sources.”

MEDIA & MARKETING

Amazon is buying MGM Studios for $8.45bn

⑥ Content (marketing) is the only marketing left1, whether you’re selling financial services or pretty much anything else.

“Amazon, the online massive retailer, confirmed [Wednesday] that it will be acquiring the nearly 100-year-old studio for a cool $8.45 billion.”

“As we’ve seen with the launch of studio streaming platforms like Disney+, the deal will also likely result in that content being pulled from competing services, once existing contracts end.”

“The deal is just the latest in a flurry of media consolidation, including Disney/Fox, Viacom/CBS and AT&T/Time Warner. As ever with these massive deals, the acquisition is pending all sorts of regulator scrutiny.”

This week | What’s new? | Why does it matter? | What’s next? | What else? / Quotable / One more thing

Quotable

⑦ Sam, a 29-year-old cryptocurrency enthusiast interviewed on this week’s FT Money Clinic podcast, summarising his strategy for investing the last £2,000 of his savings:

“I’ll either be rich, or wrong.”

This week | What’s new? | Why does it matter? | What’s next? | What else? | Quotable / One more thing

One more thing…

The seven deadly sins of the US wealth management industry - and what to do about them - are entertainingly catalogued by John Jennings in this piece for Forbes.

They are:

1. Sloth: Advisers are incentivised to provide the least amount of service possible

2. Lust: Advisers spend most of their time looking for their next client

3. Greed: Most advisers are compensated based on revenue and profitability, making them view clients as profit centres

4. Wrath: Wealth managers introduce needless complexity to justify their existence

5. Pride: Most advisors won’t say “I don’t know”

6. Gluttony: Lack of transparency about fees

7. Envy: The tax drag of investments is treated as secondary or ignored altogether

Off cuts

The stories that almost made this week’s newsletter:

🤑 Monday: Bitcoin is officially a new asset class says Goldman Sachs vs HSBC CEO says Bitcoin not for us

📲 Monday: iOS 14.6 now available with new Apple Podcasts subscriptions

👨🏼💼 Wednesday: ‘It’s wild out there’ - crypto firms lure top bankers in price boom

🚇 Wednesday: Luno forced to amend ‘misleading’ UK cryptocurrency adverts

🎧 Wednesday: You can join Twitter’s Clubhouse-like Spaces rooms from a browser starting Wednesday

🤳🏻 Thursday: mmhmm, the video conferencing software, kicks off summer with a bunch of new features

🏦 Thursday: Fintechs continue to chip away at incumbent market share

🐦 Friday: Twitter’s new products may seem ‘chaotic’ - but brands will soon see the strategy

🌿 Friday: Bitcoin mining operation is uncovered during U.K. drug bust

🤑 Saturday: Saxo Bank to enable MENA crypto investors to trade in Bitcoin, Ethereum and Litecoin

Shamelessly stolen and crudely adapted from Seth Godin