Be brief, be brilliant, be gone

Attention is dead, and intention is the new marketing currency.

Issue № 126 | London, Sunday 23 February 2025

Read on to learn why:

① Your marketing execution needs to evolve. And fast.

② Tech can help your marketing be both highly targeted and relevant.

③ T+1 settlement will be the norm by 2027.

④ Boring old payments might be the most exciting area of finance.

⑤ Speaking in person at events is a powerful way to increase your influence.

⑥ Managers should go to see the people and places where real work gets done.

⑦ Generative AI is a con.

📸 But first, flashback to a few weeks ago when I told you that if you’re still on Twitter, you’re doing social media all wrong. This week, Legal & General became the latest asset manager to abandon the platform.

What's new

This week, I attended a marketing leader masterclass that examined what CMOs are doing differently in 2025. Some key takeaways:

AI is marginalising search…

…so your content needs to breakthrough

Personalisation should be 1:1

AI is here to help, not replace

Attribution models are now indirect

Why it matters

① Marketing fundamentals don’t change. Strategic elements like having a deep understanding of your customers and competitors - and the water-tight positioning that flows from that - remain critical to your success. But the speed at which technology like AI is evolving, the frequent changes to social media platforms, the unrelenting pressure to demonstrate ROI, all mean that the tactics that have served you well until now no longer will. Your marketing execution needs to evolve. And fast.

What to do about it

Take action

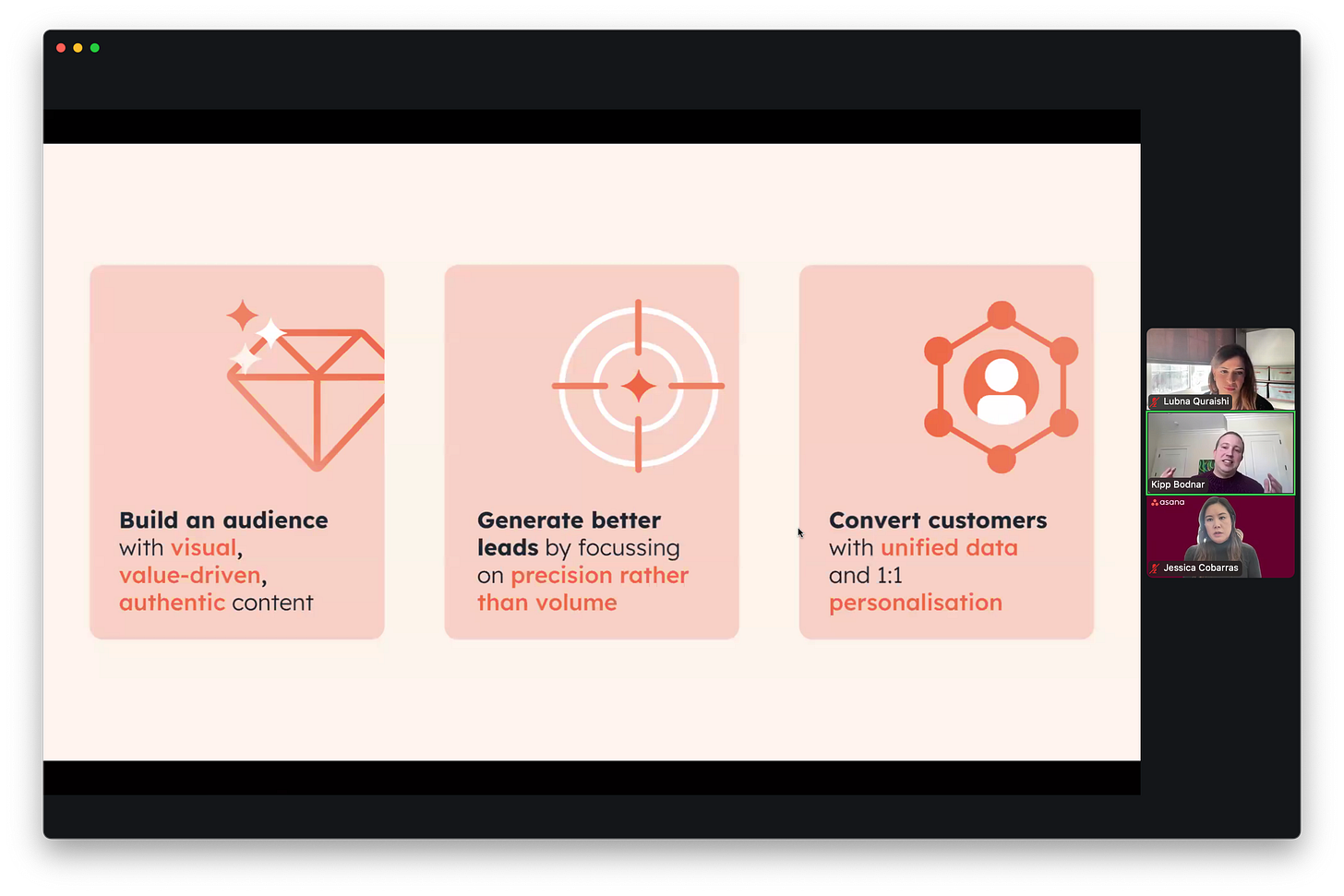

② Marketing technology can help you:

Diversify your paid media strategy: Understand that your customers need multiple touch points before taking action and spread your media appearances accordingly.

Design campaigns that are multi-channel: Be where your customers are. Integrate digital and physical channels (as we discussed last week).

Localise your playbook: Rolling out the same messaging and tactics globally will inevitably mean your marketing is less effective and you miss opportunities to delight.

Leverage AI: Your marketing team’s creativity and strategic nous is as important as ever. But let AI help with research and initial generation of content for the team to curate. Remember: it’s a bicycle for the mind.

Personalise and experiment at scale: Unify your customer data and leverage new tools to personalise your marcomms on a 1:1 basis. Get comfortable with the idea of testing and iterating at scale.

Get help

Two ways I can help you: 1) hire me as a full-time member of your team; or 2) via InMarketing, an advisory service for senior leadership teams in finance and tech.

🔎 Audit 🧭 Strategy 🖋️ Positioning ✅ Planning 🤷🏻 Problem-solving ☎️ Counsel

Top stories

The other articles that are worthy of your time.

FINANCE

UK to cut securities settlement time in 2027

③ T+1 settlement will be the norm by 2027.

“The UK will join the global move to cut the time to settle stocks and bonds in late 2027, aligning itself with an EU timetable in an attempt to attract more investors to London’s capital markets. The government on Wednesday confirmed that Britain would switch to next-day settlement on October 11 2027, in a move aimed at boosting market liquidity.”

“The confirmation follows years of intense discussions in the City of London over the issue after the US modernised its settlement times last year. Market users in New York had complained that the standard two-day period held up customers’ money for too long, increasing credit risks and slowing the pace of trading.”

“Settlement is the typically mundane but important process of matching and legally transferring assets from sellers to buyers. It was thrust into the spotlight in the US during the height of the coronavirus pandemic when some American companies, including retail broker Robinhood, blamed the two-day window for their systems being unable to keep up with increased trading volumes. The US, Canada and Mexico switched settlement for stocks, bonds and exchange traded funds in May 2024.”

TECHNOLOGY

How J.P. Morgan Payments became the bank's $4.7B growth engine

④ Boring old payments might be the most exciting area of finance.

“The bank is carving out its space in the future with Web3-driven programmable payments. In November 2024, JPM rebranded Onyx, its blockchain-based asset tokenisation platform, to Kinexys, and also renamed its JPM Coin to Kinexys Digital Payments to meet the increasing demand for asset tokenisation among major financial institutions. Since its launch in 2020, Kinexys has processed over $1.5 trillion in notional value, with daily transactions nearly surpassing $2 billion.”

“The AI-driven payment screening tool the bank launched in 2023 flags potential fraud in high-value transactions in real-time. AI also plays a key role in how JPM Payments manages its core functions, like liquidity and treasury through real-time cash forecasting.”

“JPM isn’t only vying with Citi and other banks — it’s also going head-to-head with payments heavyweights like Adyen and Stripe, which have long maintained a stronghold in the embedded finance space with their integrations. The bank’s differentiator, however, lies in its self-built global payments infrastructure, backed by internal merchant acquiring, FX services, and direct access to local clearing networks.”

MEDIA & MARKETING

Ultimate fintech event pitching guide

⑤ Speaking in person at events remains a powerful way to increase your influence, credibility and reputation.

“Have a clear events strategy. Don’t just aim for events that are popular or easy to get into. Instead, map out which events align with your company’s brand goals, industry positioning, and future direction.

Avoid overexposure. Don’t pitch the same CEO or executive to speak at every event – if you can’t avoid it, at least make sure they’re not rehashing the same speech.

Stay away from those business development and other pseudo sales titles. Consider other key figures in your company – subject matter experts, R&D leaders, or potential futurists who can provide specialised insights.

Understand the value your CEO or C-suite can bring to different events. They should speak only where they can help shape the future of the industry or where their vision can influence key stakeholders. For more tactical, industry-specific events, a subject matter expert or VP of technology might be the better choice.

Don’t just rely on one or two yearly events. Build relationships with a variety of events, from regional to global and maintain transparency with event organisers. By doing so, you can secure better opportunities for key players, and protect your own reputation as someone who is great to work with.”

WILDCARD

Leaving the seat of power

⑥ Managers should go to see the people and places where real work gets done.

“The arc of management bends towards sitting on your arse. You may intend to get away from your desk, but it holds you there nonetheless. There are always more emails to clear; there is always more work to get done. The antidote to this problem is obvious but sufficiently uncommon that it has a name: management by wandering—or walking—around (MBWA). Tom Peters, a management guru, popularised the idea in the 1980s in ‘In Search of Excellence’.”

“The more substantial benefits of MBWA come not from managers descending like minor royals, but from regular visits to the front line to identify and solve problems. Toyota is well-known for its precept of genchi genbutsu (go and see for yourself), which encourages managers to investigate manufacturing problems in person. Toyota bigwigs routinely undertake gemba (the real place) walks to see assembly lines for themselves and to drive home the firm’s philosophy of kaizen(continuous improvement).”

“Wandering around demands discipline. Bosses are busy: doing MBWA well requires managers to make a conscious effort to leave the office and to invest time solving the problems that they see. But in an era of Zoom calls and data analytics, there is still no substitute for shoe leather.”

Off cuts

The stories that almost made this week’s newsletter.

FINANCE

🥇 Chase tops UK banking charts

👮🏻♂️ FCA asks platforms to test ideas for getting more people investing

🌱 Climate targets: Barclays and Natwest drop them from executive bonuses and HSBC pushes them back 20 years

📊 Standard Chartered shares hit ten-year high ahead of results

✂️ HSBC reveals plans to cut jobs amid bid to slash costs by £1.2bn

TECHNOLOGY

🦾 UK banks differ from US on AI strategy

🇪🇸 CaixaBank sets out €5 billion technology roadmap

📉 Global fintech investment falls to seven-year low

🇪🇺 ECB investigates settlement of DLT-based transactions in central bank money

🐈⬛ Mistral’s Le Chat tops 1M downloads in just 14 days

MEDIA & MARKETING

📰 The New York Times adopts AI tools in the newsroom

🖐🏻 Five gen AI myths holding sales and marketing teams back

🤖 X launches AI-generated ads for marketers - how it will work

📲 LinkedIn: Launches improved CRM integration, expanded attribution data and publishes new guide to live event marketing

🎨 New partnership integrates Canva’s design capabilities into HubSpot

The last word

⑦ Ed Zitron on generative artificial intelligence:

“Generative AI is a financial, ecological and social time bomb, and I believe that it's fundamentally damaging the relationship between the tech industry and society, while also shining a glaring, blinding light on the disconnection between the powerful and regular people. The fact that Sam Altman can ship such mediocre software and get more coverage and attention than every meaningful scientific breakthrough of the last five years combined is a sign that our society is sick, our media is broken, and that the tech industry thinks we're all fucking morons.”

Don’t settle for marketing.

Strive for InMarketing.

Wishing you a productive week,