Bicycles for the mind

Artificial intelligence is overhyped, misunderstood, and underestimated.

Issue № 107 | London, Sunday 15 September 2024

Read on to learn why:

① The value of AI is to increase human capabilities not replace them.

② The dangers of AI centre on loss of trust.

③ Post-2008 capital requirement rules are being watered down worldwide.

④ Digital assets can’t go mainstream without digital money to match.

⑤ CMOs need to be savvy businesspeople and superb marketers.

⑥ CEOs have fewer and fewer reasons to contemplate M&As.

⑦ Communication is invaluable.

What's new

“People can’t tell our chatbots are robots”, claimed a financial adviser this week, according to Citywire.

In short:

“Speaking at Citywire’s North Retreat last week, Robert Morse, senior partner at The Private Office, said his firm’s marketing team has begun using AI-driven chatbots to speak to prospective clients. ‘Apparently, people cannot tell that they’re not human,’ he said. ‘The technology is advancing incredibly quickly’.”

“Matthew Sinclair, a director at Durham-based Wealth of Advice, said his firm has built a system using Microsoft BackOffice to track appointments and client log-ins among other things. ‘We are certainly using those tools,’ he said.

“Jacqui Davidson-Slack, director of Cheshire-based Premier Wealth Solutions, uses AI for transcribing client meetings, ‘saving us a tremendous amount of time and effort. In the future, [it] might replace some of the paraplanning duties we are using at the moment,’ she said. Despite AI’s benefits, Davidson-Slack is concerned about its possible dangers and said she has had clients who have asked to transfer money after seeing deepfake scam videos.”

Why it matters

To be charitable to the interviewees here, some of their views are…ill-judged. They sound like they’re prioritising appearing au fait with the latest hype over considering what’s actually best for their firms. Whether people can tell they’re interacting with a machine or not is hardly the point, pulling the wool over your clients’ eyes is never good business. Software that tracks appointments and client log-ins, although useful, hardly qualifies as an application of artificial intelligence. Davidson-Slack is the only leader here who hints that she understands both the value of AI and its dangers.

① The value of AI, like any tool, is to increase human capabilities, enabling individuals to accomplish more with less effort. Steve Jobs understood this about computers, labelling them ‘bicycles for the mind’. In a now-famous 1990 interview, Jobs related an article that he had read as a child, that compared the efficiency of different animals' movements over distance.

"The condor won, came in at the top of the list, surpassed everything else, and humans came in about a third of the way down the list. But somebody there had the imagination to test the efficiency of a human riding a bicycle. Human on the bicycle blew away the condor, all the way off the top of the list. And it made a really big impression on me, that we humans are tool builders, and that weakened fashioned tools that amplify these inherent abilities that we have to spectacular magnitudes. And so for me a computer has always been a bicycle of the mind, something that that takes us far beyond our inherent abilities."

AI appears to be the latest and perhaps most dramatic manifestation of this phenomenon. But - hugely impressive though the technology is - we can’t get carried away with the wonder of it. Remembering it’s a tool and continuously questioning how and why to use that tool are key. Because like any powerful tool, it’s also inherently dangerous.

② The dangers of AI centre on loss of trust. When anything can be faked with ease using the computer we all carry around in our pockets, how can we know what’s real anymore? (It’s a danger so serious that the state of California is preparing to regulate it with a bill known as SB 1047.) When it comes to financial services, there is every indication that clients are comfortable taking advice from a machine - but be transparent about what they’re interacting with.

From a marketing perspective, by making it vastly easier and faster to produce content of all kinds, AI has transomed the content marketing landscape. Mediocre marketers are panicking. Savvy ones know this is an opportunity to differentiate their content in a sea of AI-sameness.

What to do about it

Take action

Make sure you ignore the hype, understand the possibilities, and apply them judiciously. Be:

Inquisitive - Keep up-to-date on AI, learn what it can do, think it about how it can be applied to your business. When iOS 18 hits our devices next week, even your grandmother will start to become familiar with its abilities. InMarketing’s AI page is a good place to start.

Exhaustive - Audit your marketing function. Leave no stone unturned. Where are the areas in which riding a bicycle makes more sense than walking?

Acurate - Resist the urge to introduce a new layer in your martech stack and tell your board or a journalist it’s AI. Not all useful software is.

Pragmatic - Introduce AI in your business if - and only if - it’s going to be valuable. Will it increase your revenues, lower your costs, or mitigate risk? Anything else is an ill-judged distraction.

Hell, you could even ask AI to provide help with your strategic planning.

Get help

InMarketing is a dynamic repository of help for senior leadership teams in finance or technology who want to drive growth. Browse others’ ideas, find tactical support, or leverage marketing advisory.

Top stories

The other articles that are worthy of your time.

FINANCE

Chancellor meets top City bosses after relaxing proposed banking reforms

③ Post-financial crisis capital requirement rules are being watered down worldwide.

“The PRA said the new requirements for major UK banking firms will be ‘virtually unchanged’ by the package of reforms, with an expected increase by less than 1% from 2030. Previously, its proposed changes were estimated to have led to a 3% increase.”

“Another significant change from the original proposals include lower capital requirements for lending to small and medium-sized businesses, and for infrastructure projects. This means it will not become more difficult for banks to lend to growing firms and to fund big projects, something which had been raised as a concern by the City.

“The rules, which are yet to be finalised, will come into force at the start of 2026. Other countries are drawing up their own reforms to the rules, with the US central bank also outlining plans to water down earlier proposals.”

TECHNOLOGY

Swift plans to settle digital securities transactions using Swift payments

④ Digital assets can’t go mainstream without digital money to match.

“Today Swift outlined its vision for digital assets and payments. That includes potentially supporting the settlement of digital asset transactions using the Swift network. However, the first step will be to enable ‘multi-ledger Delivery-versus-Payment (DvP) and Payment-versus-Payment (PvP) transactions on Swift’s secure, global platform’.”

“Many view a lack of regulated on-chain cash as holding back the progress of DLT and regulated digital assets. Hence, the current ECB trials for wholesale DLT settlement, which involve both linkages to existing payment systems, such as a Trigger solution, and a wholesale CBDC. Recognising this, Swift is exploring ways to enable tokenised asset settlement with the cash leg using fiat currencies. This solution could migrate to CBDC or tokenised deposits as more of them come on line.”

“Additionally, it wants to explore interlinking separate blockchain networks. For example, linking the Regulated Settlement Network with other initiatives.”

MEDIA & MARKETING

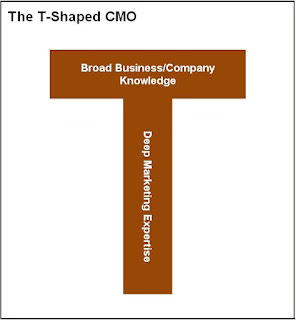

Why CMOs need to become T-shaped leaders

⑤ CMOs need to be savvy businesspeople and superb marketers.

“In The Third Annual CEO Study on Marketing and the CMO conducted by Boathouse in 2023, nearly half (49%) of the surveyed CEOs rated their marketing performance as ‘Best in Class’, up from 24% in the 2022 edition of the survey. However, the survey also identified areas where CEOs weren't as satisfied with CMO performance. For example, only 22% of the surveyed CEOs gave their CMO a grade of ‘A’ on strategy, and the lowest number of ‘A’ grades given to CMOs was on their "ability to drive company growth."

“Recent research by Transmission consisted of interviews with current and former directors (CMOs and non-CMOs) at public and private B2B boards and a survey of 311 B2B CMOs. […] When it comes to earning greater trust from the CEO, the most important of these attributes is called ‘T-Shaped skills’. A T-Shaped CMO understands the company's business model, what drives profits in the business, and what levers company leaders can pull to impact financial performance. He or she is knowledgeable about current economic conditions and trends and has a solid understanding of the competitive dynamics of the markets the company serves.”

“Perhaps most importantly, a T-Shaped CMO can place marketing in the context of the company's overall business strategy and provide sound, evidence-backed advice that will help the CEO and other senior leaders make the trade-offs that are an inevitable part of running a business in a complex, always-changing environment.”

WILDCARD

Is the era of the mega-deal over?

⑥ CEOs have fewer and fewer reasons to contemplate M&As.

“Although firms’ profits and valuations have shot up over the past two decades, the number of big transactions has not. Since 2004, for instance, the number of listed American and European firms worth more than $10bn has more than doubled. But global transactions worth more than $10bn have barely budged as a share of the value of deals, at a fifth. Despite the breakneck growth of private markets in recent years, the largest ever buy-outs predate the global financial crisis of 2007-09.”

“Would-be empire builders face more scepticism from investors than in the past. Sprawling global conglomerates are thoroughly unfashionable. General Electric, an industrial icon, completed a split into three separate companies earlier this year. Vodafone, which pulled off another of the largest takeovers in history when it bought Mannesmann in 2000, is now meekly selling off its operations. The tech firms that have replaced the financial, industrial and communications empires as the world’s most valuable companies have not shown the same willingness to risk their business on big, adventurous tie-ups. Big tech’s most important dealmaking moves today involve comparatively small investments in artificial-intelligence startups.”

“Another, even more potent, brake on mega-deals is politics. Suspicion of big companies across the political spectrum has led to more radical and less predictable thinking on antitrust. Even when firms do prevail in legal scuffles with regulators, as Microsoft did in its $69bn acquisition of Activision, they face lengthy periods of uncertainty between signing and completing transactions, making them less likely to pursue big deals. Microsoft’s acquisition of the video-game developer took nearly 21 months.”

Off cuts

The stories that almost made this week’s newsletter.

FINANCE

📈 Barclays calls on UK to ‘break down barriers’ keeping £430bn from markets

🎯 Andrea Orcel sets his sights on Commerzbank

🪨 BlackRock teams up with Euroclear on private markets access

🤴🏻 Abrdn and Schroders turn to finance chiefs in bid to revive fortunes

✂️ HSBC mulls merger of investment banking and commercial arms

TECHNOLOGY

💵 Bank of America spending $12B on technology annually

💶 Google and Apple face billions in penalties after losing E.U. appeals

💷 Lendinvest: Fintech lands £500m investment from JPMorgan

🔌 UK government says data centres are now Critical National Infrastructure

🤑 Abu Dhabi’s Mubadala takes stake in Revolut

MEDIA & MARKETING

👮🏻♂️ FCA sets out temporary measures for firms on ‘naming and marketing’ sustainability rules

🪧 Publishers rally as Google advertising antitrust trial restarts in US

📰 Jamie Heller to be next top editor of Business Insider

🤖 Why CMOs’ unrealistic AI expectations will cause projects to be abandoned

💎 Why marketing is not a luxury for financial institutions

The last word

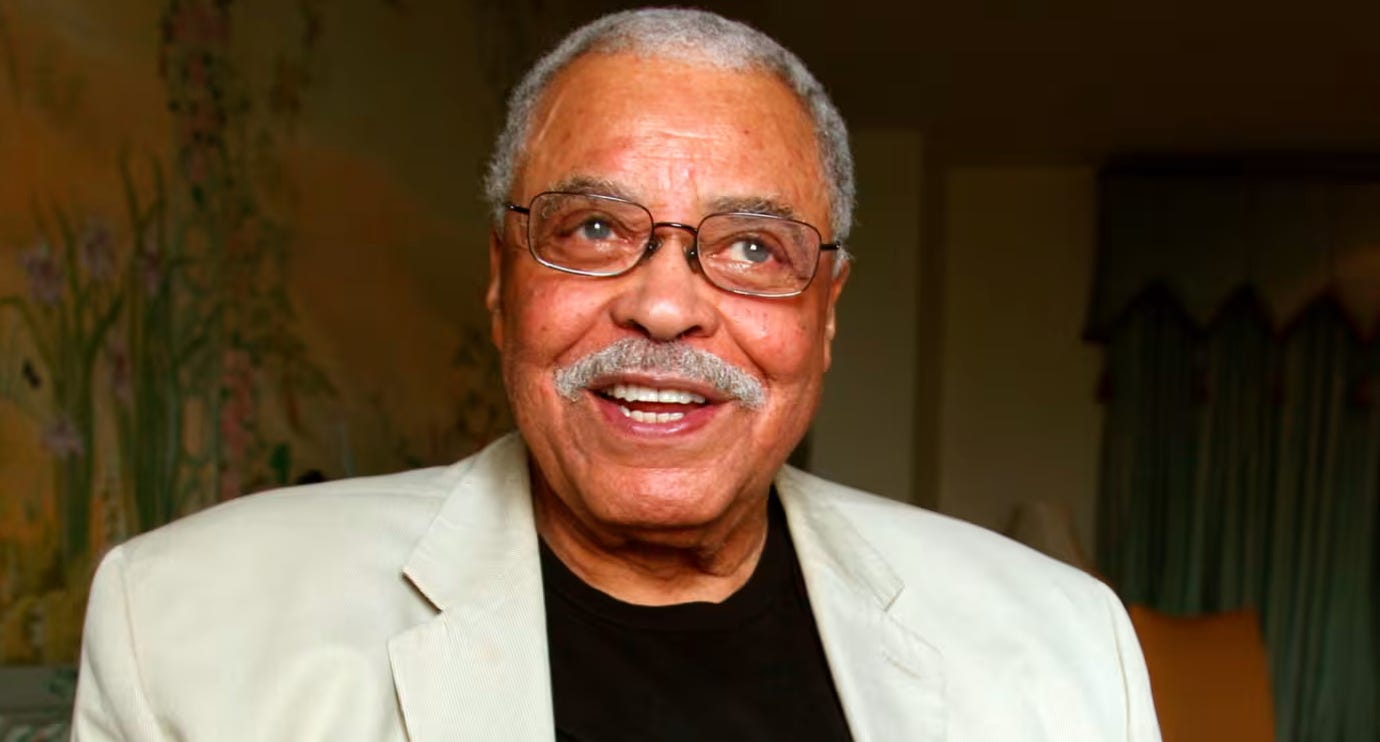

⑦ James Earl Jones, who died this week, on his childhood speech impediment:

“One of the hardest things in life is having words in your heart that you can’t utter.”

Don’t settle for marketing.

Strive for InMarketing.

Wishing you a productive week,

P.S. I had a hot date at Le Caprice this week and can confirm it’s as good as ever.