Issue № 131 | London, Sunday 30 March 2025

Read on to learn why:

① Your brand is the bond between your business and its customers.

② Customers and employees alike should feel part of a rebrand story.

③ European asset managers trail their US counterparts.

④ Fintechs continue to chase the ‘everything app’ of financial services.

⑤ You can’t rely on automated lead nurturing in B2B financial services.

⑥ You’re the only person responsible for your own happiness at work.

⑦ Customer needs, not tech for tech’s sake, should be your North Star.

📸 But first, flashback to last November when I told you it was time to move to Bluesky. This week, it looks like Barack Obama took my advice.

What's new

This week, nine months after the merger of London & Capital and Waverton, the two firms announced a rebrand to W1M, a £21bn wealth firm. Citywire reports.

In short:

“London & Capital and Waverton IM have rebranded to W1M, inspired by the postcode of London & Capital’s first office in Cavendish Street in Marylebone.”

“While hooking its name on London & Capital’s first home, W1M chief executive, Guy McGlashan, also highlighted that at a glance the new name resembles WIM, the acronym of Waverton Investment Management. The protection of the pair’s heritages extends to brand colouring, with the Waverton teal mixed with London & Capital orange.”

“To avoid confusion in the market, the firm’s multi-asset funds and model portfolio service will continue to operate under the Waverton name. With increased scale, McGlashan said W1M will have the capacity to move into new business areas. Private markets is one segment he is particularly keen on developing.”

Why it matters

What a pleasure to have a chance to showcase a rebrand done well rather than nitpick the many that aren’t. This story matters because it’s a case study for a rebrand that was necessary (you’d be amazed how many aren’t), respected the history of the two firms involved, and resulted in something that feels fresh and truly ready for the future.

① By their very nature, rebrands are dangerous exercises. Your brand is the bond between your business and its customers. It’s how a customer feels when they think of you. Replacing it is not dissimilar to changing a plane’s engine mid-flight. New CMOs and even CEOs are sometimes drawn to rebrands as a way to make their mark but they should only ever undertaken when there is no alternative. Few people remember it now but Monzo started life as Mondo. When they came up against an IP challenge, they - wisely - kept their rebrand minimal.

② Respecting the history of one brand is hard enough. Doing so simultaneously for two brands is devilishly so. And, yes, McGlashan and his team got lucky with the similarities between the postcode and the Waverton acronym. But it’s still a great example of a rebrand that doesn’t alienate. Customers and employees alike feel part of the story. They can see the ‘old’ in the ‘new’. And the ‘new’ in this case is short, elegant and confident, it will work just as well on digital channels as embossed on Smythson stationary, as befits a premium wealth management brand.

What to do about it

Take action

If you’re contemplating a rebrand, consider whether it’s:

Necessary: Ask yourself what problem you’re trying to solve with your rebrand. Is a rebrand really the best solution?

Respectful: Too many throw the baby out with the bathwater. Be cognisant of the best aspects of your brand and retain them. Don’t be Scottish Widows.

Future-proof: Keep one eye on how your brand will have to evolve. Are you considering launching in new markets or trying new channels. Right now, how your brand looks on social media is important. But should you also be considering VR and AR environments?

Get help

Two ways I can help you: 1) hire me as a full-time member of your team; or 2) use InMarketing, an advisory service for senior leadership teams in finance and tech.

🔎 Audit 🧭 Strategy 🖋️ Positioning ✅ Planning 🤷🏻 Problem-solving ☎️ Counsel

Top stories

The other articles that are worthy of your time.

FINANCIAL SERVICES

Active ETFs: A lifeline for Europe’s struggling asset managers?

③ European asset managers continue to trail their US counterparts.

“The very premise of so-called active management has been severely tested by the rise of index tracking, a concept popularised by large US-based groups. It promises returns that almost match those of an index, but at a much lower cost than stock picking. Investors have embraced the proposition. Across Europe, money has drained away from names such as Jupiter, Aberdeen and Schroders and into the likes of State Street, Vanguard and BlackRock. US groups now have $5.3tn under management across Europe, more than double the amount they managed a decade ago.”

“As they try to resist the US onslaught, British and European groups have already pulled many of the levers available to them: cutting costs, appointing new chief executives, rebranding themselves and merging with peers in an attempt to attain greater scale. Now, faced with an increasingly existential struggle to keep active management competitive, many are tentatively embracing an idea that their tormentors brought to these shores: active ETFs.”

“Sceptics note that US managers such as JPMorgan and BlackRock have established an early lead in Europe. JPMorgan Asset Management, the market leader, runs $32bn worth of active ETFs — equivalent to more than half of Jupiter’s entire assets under management.”

TECHNOLOGY

Robinhood moves into wealth management and private banking

④ Tech firms continue to chase the ‘everything app’ of financial services.

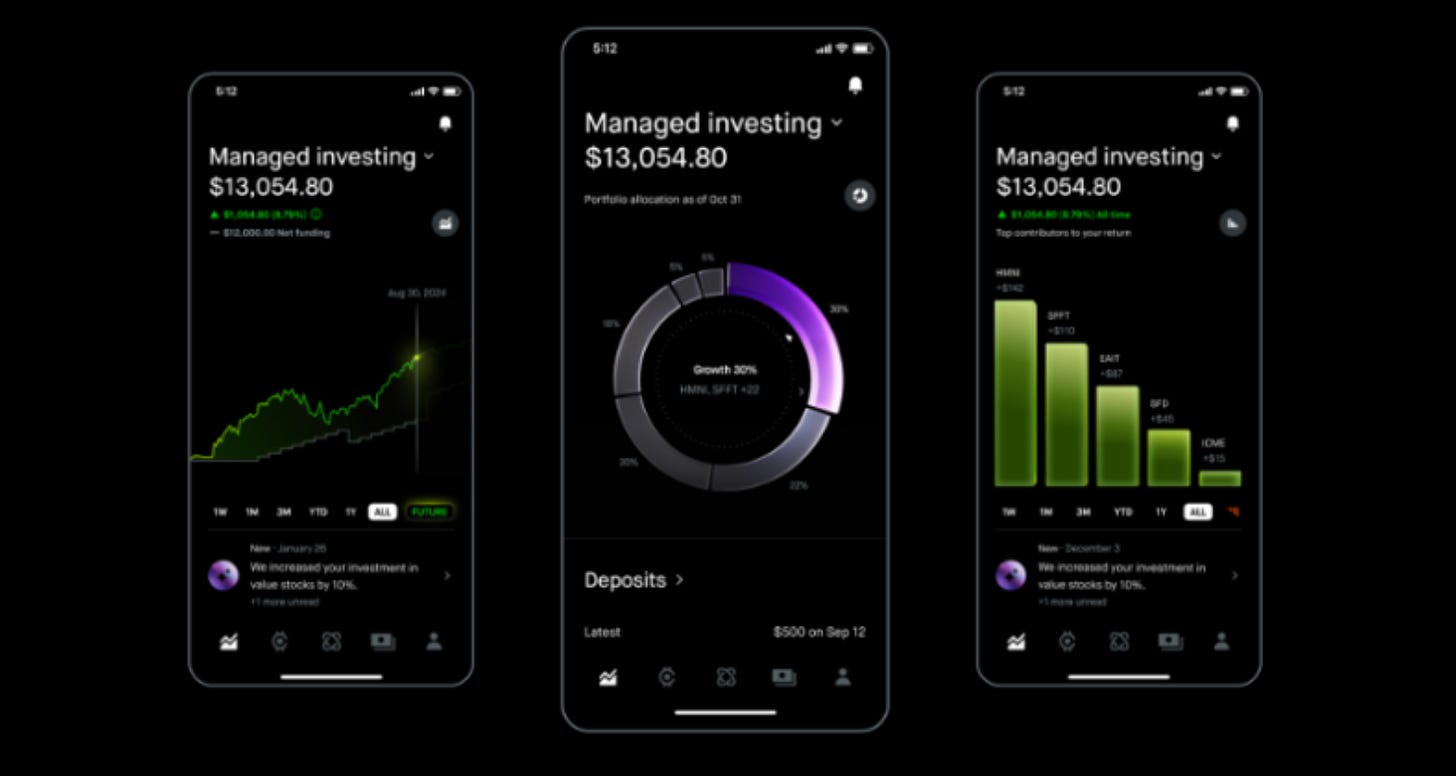

“Stock trading app Robinhood continues to build out its product suite, adding wealth management and private banking services, as well as an AI investment tool. The firm says its Robinhood Strategies and Robinhood Banking will bring its premium Gold members features that were once the preserve of the rich.”

“Strategies is a wealth management service with a 0.25% annual fee, capped at $250. Unlike a robo-advisor, users gain access to portfolios of exchange-traded funds managed by investment experts.”

“Meanwhile, Robinhood Bnking promises the private banking experience to Gold members, offering them checking and savings accounts with extras such as estate planning and professional tax advice. Users also get four per cent annual percentage yield on savings, perks like tickets to exclusive events such as the Met Gala, and cash delivered to their doorstep to save runs to the ATM.”

MEDIA & MARKETING

Does automated lead nurturing really work? A new study challenges the hype

⑤ You can’t rely on automated lead nurturing in B2B financial services.

“A new Journal of Marketing study finds that ALN is effective—but only under specific conditions. Some businesses experience significant increases in sales, while others see little to no impact. ALN works best when used for new leads, short sales cycles, and lower-value deals. Its benefits decline in high-ticket purchases or industries where buyers conduct extensive independent research.”

“Businesses should measure ALN effectiveness by tracking:

Lead-to-sales meeting conversion rates (Does ALN drive actual conversations between buyers and sales teams?)

Sales cycle speed (Does ALN shorten the time it takes to close a deal?)

Revenue impact (Does ALN increase the number of closed deals and overall profitability?)”

“Companies that rely too heavily on automation risk alienating high-value prospects who expect personalised, consultative selling. Instead of viewing ALN as a standalone solution, businesses should:

Segment their leads and tailor ALN for different customer groups (e.g., new vs. returning buyers).

Use ALN to complement human interactions, rather than replace them, particularly for complex sales.

Refine ALN strategies over time by tracking real business outcomes rather than engagement metrics.”

WILDCARD

In a slump at work? Here’s how to motivate yourself.

⑥ You’re the only person responsible for your own happiness at work.

“Poor performance management, lack of visibility, repetitive routines, and restricted growth opportunities can result in feelings of frustration, stagnation and boredom. Maybe you have a boss that doesn’t see your potential. Maybe there’s lots to do, but none of it excites you.”

“In an uncertain economy, making a career move might not feel realistic or desirable. Especially for remote workers, there might not be many opportunities for organic networking opportunities.”

“Here are five ways to reignite motivation at work:

review past feedback on your performance to create a mini performance review;

seek a stretch assignment;

explore opportunities to shadow others;

strengthen skills by sharing knowledge; and

recognise incremental wins.”

Off cuts

The stories that almost made this week’s newsletter.

FINANCIAL SERVICES

🇧🇷 Nubank has conquered Brazil. Now it is expanding overseas

🫱🏼🫲🏾 Private equity market bullish on resurgence in deals

🫣 Launches of private asset ETFs raise concerns in funds industry

🏠 Santander becomes first major lender to loosen mortgage rules

💰 James Gorman to join General Atlantic as adviser ahead of IPO

TECHNOLOGY

🪙 Fidelity Investment to roll out stablecoin

👏🏻 Ubyx bank stablecoin off-ramp network launches

🎓 Lloyds sends 200 senior staff to Cambridge University for AI bootcamp

📈 Why banks aren't seeing high returns on generative AI

🇬🇧 Fintech leads UK tech hiring boom

MEDIA & MARKETING

😍 How CEOs view their CMOs and marketing

🤲🏻 Performance marketing vs. brand-building

💀 Think email is dead? Think again.

📧 AI and email marketing: All hype or real game-changer?

🔟 Martech partnerships that are changing the marketing landscape

The last word

⑦ Don Relyea, chief innovation officer, US Bank on how to implement technology successfully:

“We see a lot of technology that’s been combined into a product, but [...] it’s a product looking for a customer need and then we’ll also see some where they’ve actually been really thoughtful about what their customers need and what the customer use cases are and those are the gems.”

Don’t settle for marketing.

Aspire to InMarketing.

Wishing you an influential week,

P.S. Yes it’s a cliché but sometimes the journey really is as good as the destination.