Whiter than white

Financial brands need an independent, trusted framework to demonstrate their green credentials.

Issue № 60 | London, Sunday 23 October 2022

Read on to learn why:

① Banks’ green credentials are being scrutinised by regulators.

② Honesty is always the best policy.

③ It’s really hard to make money in retail banking.

④ The ship may have sailed on a European superapp.

⑤ Great marketers are defined by their ability to interpret data.

⑥ A week can be a long time in finance too.

⑦ Twitter still rules (seriously).

What's new

The UK’s Advertising Standards Authority has banned HSBC’s climate ads (although that didn’t stop the bank launching four new ESG ETFs this week nor continuing to run its green ads in Canada). The Guardian reports:

① In short:

“HSBC has suffered a fresh blow to its green credentials after the UK advertising watchdog banned a series of misleading adverts and said any future campaigns must disclose the bank’s contribution to the climate crisis.”

“The ruling by the Advertising Standards Authority followed dozens of complaints over posters that appeared on high streets and bus stops in the lead-up to the Cop26 climate change conference in Glasgow last October. The watchdog said the adverts, which highlighted how the bank had invested $1tn in climate-friendly initiatives such as tree-planting and helping clients hit climate targets, failed to acknowledge HSBC’s own contribution to emissions.”

“HSBC’s latest annual report said its financed emissions – clients and projects it provided loans and services to – were linked to the release of 65.3m tonnes of carbon dioxide a year. That figure only accounted for its oil and gas clients but would probably be much higher if other carbon-heavy industries such as utilities, construction, transport and coalmining were included, the ASA noted.”

Why it matters

At a time when investors are increasingly sceptical on asset management ESG claims and environmental terms confuse Brits and make them wary of greenwashing, HSBC’s little contretemps with the regulator matters because it reminds us that financial brands need to be - please excuse the lousy pun - whiter than white on green matters.

As I wrote back in June,

If a brand is going to jump on a cause, it has to be able to substantiate its statements with facts and action.

② How to do so? We’ve talked about B-Corp status before and there are other ways for a business to measure and report on its ESG credentials - firms like Greenomy spring to mind. What counts is that you do so - and your marketing reflects the results.

Think how different HSBC’s story would have been if their ads had led with a mention of their CO2 emissions before highlighting some of the initiatives the bank is taking to counterbalance these - as they work towards net-zero. Honesty goes such a long way.

What to do about it

Take action

Until such time as there is a standardised way for the industry to measure and report on ESG credentials, it’s important for you to:

Establish your own framework: Create a company-wide framework for measuring and reporting on your ESG credentials. Make sure it’s understood by all.

Communicate the results transparently: While annual reports are currently the places where such information tends to be buried, being forthright about what you’ve still got to fix goes a long way to building trust so publish it more readily.

Report on your progress regularly: Climate change is a problem that affects us all and for which we’re all responsible, from individuals to global corporations. And none of us are perfect. So, reporting on progress regularly is critical. It says “we’ve got work to do. And we’re doing it.”

Get help

Visit InMarketing, my resource library for leaders in finance or technology who want to innovate, interact and influence.

Join my InMarketing Twitter community, where you can ask questions of me but also your fellow senior marketing practitioners.

Share

If you found this useful or know someone who would, please share it. It would really help me to grow the community of regular IMTW readers.

Top stories

The other articles that are worthy of your time.

FINANCE

Goldman Sachs’s disastrous Main Street gamble

③ It’s really hard to make money in retail banking. Even for the Sachs of Gold.

“It is clear now—after the third reshuffle in almost as many years was announced on October 18th—that Goldman should have stuck to Wall Street. The turn in the credit cycle is revealing just how terrible Goldman is when it comes to consumer lending.”

“A comparison with JPMorgan’s lending business shows just how far behind Goldman is. Goldman’s loan book is a sixth of the size of its rival’s; its consumer loan book is a ninth as big. And the firm is setting aside relatively more for credit losses in the third quarter. Goldman anticipates losing 13% of its consumer credit-card and instalment loans. JPMorgan expects to lose just 6%.”

“The reshuffle will split up Goldman’s consumer bank, bundling its consumer savings and wealth products into the asset-management arm, and sticking the lending ones into a new ‘platforms’ business, where they will sit alongside wholesale and business banking. This might help to disguise some of the consumer bank’s thorniest problems. The reshuffle will also wrap together the firm’s trading and investment-bank businesses, which should make it easier for shareholders to compare Goldman’s performance in its Wall Street businesses with those of its rivals, like Morgan Stanley or JPMorgan, who organise themselves this way.”

TECHNOLOGY

Will Europe get a superapp, and who will it be?

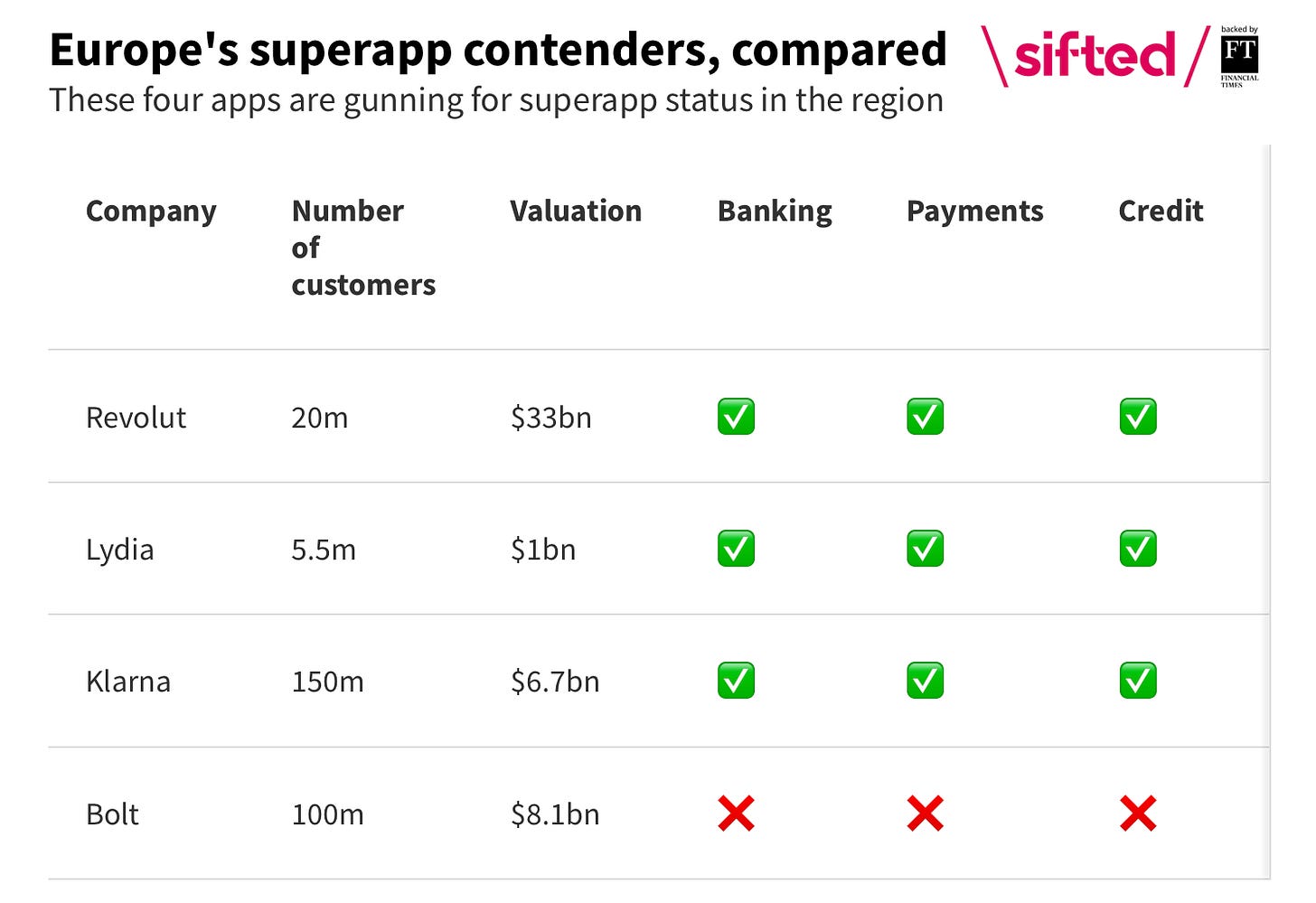

④ The ship may have sailed on a European superapp.

“So far, four European startups have made their superapp intentions clear: Klarna, Revolut, Bolt and Lydia. Three out of the four are fintechs: unicorns Klarna, Revolut and Lydia. Bolt started in transport then launched food delivery. The business case for launching more products in-app is strong, because it’s more expensive to acquire new customers than it is to try and sell existing ones something more.”

“Even if one European app did manage to capture enough users for a multi-product offering, they’d be up against another challenge: the fragmented regulatory landscape.”

“Investors tell Sifted that they expect the end of the race to a superapp in Europe to look more like a relay — with separate financial, mobility and commerce superapps rather than one multi-sector app that consumers never have to leave. The neobanks got there first. But at the same time, by the point that Revolut, Klarna and Bolt arrived on the scene, ecommerce in Europe was already dominated by Amazon, and mobility was dominated by Uber.”

MEDIA & MARKETING

Handle with care: the data challenges facing marketers

⑤ Great marketers are defined by their ability to interpret data and come up with actionable campaigns based on it.

“Once Apple, Google and Mozilla end their web browsers’ support for third-party cookies, first-party data will become even more important to marketers. That material, once it’s fed into the latest business intelligence tools, will allow for more sophisticated and focused campaigns.”

“The main goal should be to find where customers are, especially if you’re weighing up potential investments in new channels such as the metaverse.”

“Data virtualisation is emerging as an effective way for marketers to achieve a holistic view of data across the gamut of sources. As organisations struggle to process the growing volume of data being generated, the use of this technique is set to increase by an average of 20% a year until 2031.”

WILDCARD

As Liz Truss resigns, meet some of the shortest-serving CEOs

⑥ A week can be a long time in finance too.

“Alan Fishman spent just 17 days as CEO of Washington Mutual before the bank collapsed amid the mortgage crisis.”

“John Flint was described as a “safe pair of hands” for HSBC on his appointment in October 2017. But he served for only 18 months before stepping down in August 2019.”

“Barclays has quite a history of quick CEO turnovers: four have lasted less than three years since the 1990s. Aside from Michael O’Neill, who resigned for health reasons after two months, Bob Diamond was the shortest-lived.

Appointed in January 2011, he was sacked from the top job after just 18 months over the bank’s involvement in the Libor-fixing scandal, which resulted in £290m in fines.”

Off cuts

The stories that almost made this week’s newsletter.

FINANCE

😬 Why traditional bankers make terrible fintech CEOs

🗂 JPMorgan: tokenising euro deposits; building platform to connect founders and investors; and hiring former exec from Celsius delisted implosion

👨🏼💻 NatWest to launch BaaS business in UK

🥄 Is Credit Suisse selling off the family silverware?

👩🏻💻 Schroders Personal Wealth hires Barclays head of tech

TECHNOLOGY

📈 89% of board directors say digital is embedded in all business growth strategies

🤝 Visa Direct integrates with Thunes

🤑 UK is now the largest crypto economy in Europe

👨🏼🔧 Microsoft is laying off 'under 1,000' workers

🏦 CBDCs: Congressman believes its necessary for US to remain competitive while Hong Kong unveils completed retail CBDC project

MEDIA & MARKETING

⌛️ CMO tenure is at its shortest in more than a decade

☣️ How much trouble is Mark Zuckerberg in?

🐦 Elon Musk reportedly wants to lay off 75% of Twitter’s staff

📲 Kanye West to acquire ‘uncancelable’ social media platform Parler

The last word

⑦ Simon Kuper writing about Twitter in the FT this week:

“To condemn Twitter because of trolls is like condemning the printing press because of Mein Kampf. The trick is to filter out the rubbish.

My policy on Twitter is to follow beautiful minds, specialists or both. Whereas Facebook and Instagram confront you with horrifying images of your friends’ perfect kids and perfect breakfasts, Twitter has zones of substance.”

Don’t settle for marketing.

Strive for InMarketing: innovate, interact, influence.

Wishing you a productive week,

P.S. My week at Sibos foiled my plans to bring you IMTW last Sunday but at least I returned from Amsterdam with a great restaurant recommendation for you. Try Jansz. It’s polished, friendly, and a little indulgent.