Robo Adviser (†2025)

Clients care about what you do for them, not how you do it.

Issue № 143 | London, Sunday 5 October 2025

Read on to learn why:

① Our industry is often dangerously introspective.

② Clients really only care about one thing: can you solve their problem?

③ The division between EU and US financial regulators is growing.

④ Crypto bros lost. The adults are in charge of digital finance.

⑤ Every brand should be able to convey its purpose in seconds.

⑥ Moguls are the new royalty. In power and longevity.

⑦ Payments systems should be built on public infrastructure.

🙏🏻 But first, I have a favour to ask you. I’m looking for my next role. Would you mind spending a moment to share this with your network? It would really help.

What's new

JP Morgan scrapped Nutmeg this week and launched a new investing brand, CityAM reports.

In short:

“JP Morgan is to scrap its Nutmeg brand and roll its services into a new consumer wealth management business as it intensifies its battle with market leader Hargreaves Lansdown.”

“The new service, dubbed JP Morgan Personal Investing, will offer managed investments, pensions, and ISAs alongside digital financial planning tools and dedicated relationship managers.”

“The bank will also launch what it calls a ‘DIY investment platform’, offering investors the ability to buy and sell their own shares, bonds, funds and other asset classes.”

Why it matters

A couple of months ago, when Nutmeg’s losses hit £40m a year, I wondered out loud how patient JP Morgan was going to be. It’s now obvious it always had a bigger plan. Of course it did.

① So, while commentators have been quick to pitch this story as a landmark moment - the death of the so-called robo-adviser - I think this story matters because it reminds us that our industry is often dangerously introspective. Very few people outside finance - indeed only some within it - could really tell you what a robo-adviser was or how it differed from a traditional asset manager. The wealth management sector has been obsessed with the concept for more than a decade, while its clients have remained blissfully indifferent to it. Their priorities lie elsewhere. I know, I’m one of them.

I invested a little with Nutmeg in its earlier incarnation - mostly because, at the time, I was working for a wealth manager with robo-adviser ambitions and wanted to understand the concept. I enjoyed the app and liked the ‘challenger’, plain-spoken nature of the brand. But mostly, I kept the money there for one reason only: it performed. And because I worked in the sector, I know a little more than most about why it performed - i.e. the lower fees enabled by using tech rather than humans to manage assets - but I can’t say I ever cared ‘how’ it was done.

By 2021, I had most of my investments with Nutmeg. So, when Wall Street’s best swept in - with all the safety, aspiration, and promise of more services the JP Morgan brand conferred - that was icing on the cake. I had no affiliation to the robo-adviser concept or to Nutmeg’s purpose. I just wanted my money to grow safely.

Nutmeg’s integration into JP Morgan underscores the shifting dynamics of the retail investment market, where established financial services groups are increasingly absorbing or outcompeting smaller fintech challengers. Meanwhile, just this week, Robinhood is taking aim, Quilter is rebranding, and - most notable of all - Lloyds and Schroders are abandoning their joint venture and rethinking their approach to wealth management. Serving the mass-affluent is clearly alluring but a tricky thing to get right.

What all of these brands would do well to remember is that clients want sustainable, safe growth. And they don't much care what you’re called or if you’re using humans, robots or clever monkeys to deliver it.

What to do about it

Take action

② I was once asked by a CEO to trumpet the fact that he’d hosted an offsite for his leadership team and they’d spent time thinking about the future of the business, seemingly unaware that not a soul would care. Nor do clients or prospects care about your flashy new website, your sharp logo, your experiecned new senior hire, your unique methodology, your latest award, your growing team, your clever technology, your smiley support staff. They care about one simple thing: can you solve their problem better than anyone else?

The action to take this week is simple: Audit all of your external messaging through the lens of ‘is this about us or about what we do to eliminate our clients’ problems?’ Hint: it should be the latter.

Get help

Two ways I can help you: 1) hire me as a full-time member of your team; or 2) use InMarketing, an advisory service for senior leadership teams in finance and tech.

🔎 Audit 🧭 Strategy 🖋️ Positioning ✅ Planning 🤷🏻 Problem-solving ☎️ Counsel

Top stories

The other articles that are worthy of your time.

FINANCIAL SERVICES

Christine Lagarde calls for tougher rules

③ The division between EU and US financial regulators is growing.

“European Central Bank president Christine Lagarde has called for financial regulators to tighten restrictions on hedge funds and other groups in the ‘darker corners of finance’ to reduce their advantage when competing with banks, as she warned against ‘regulatory rollback’. Her call for a beefing up of rules on hedge funds, private equity and credit funds to achieve a ‘levelling up’ with banks contrasts with the approach of US regulators, which are instead easing rules for lenders.”

“Lagarde’s speech on Friday prompted a backlash from hedge funds, which denied benefiting from lighter rules than those for banks and said they were less risky than traditional lenders because they used less leverage.”

“EU bank executives have long complained about competition from non-bank rivals such as hedge funds that they argue benefit from softer rules. Lagarde expressed her support for this idea.”

TECHNOLOGY

Swift to launch blockchain in response to rise of stablecoins

④ Crypto bros lost. The adults are in charge of digital finance.

“Swift said on Monday that it would work with Bank of America, Citigroup and NatWest, among other banks, to create a shared digital ledger that would be used to facilitate transactions in tokenised products including stablecoins.”

“Swift said the move would improve cross-border transactions and that the blockchain would allow it to ‘record, sequence and validate transactions and enforce rules through smart contracts’.”

“Swift will work with blockchain technology company Consensys to create a prototype of the ledger, which it will then test with the banks to decide which transactions — in which currencies and between which countries — it should offer first.”

MEDIA & MARKETING

FCA unveils ‘elevator pitch’ in bid to silence critics

⑤ Every brand should be able to convey its purpose in seconds.

“The FCA has overhauled its communications strategy, signalling the role that regulation can play in helping businesses flourish. The new messaging includes a fresh statement clarifying the regulator’s purpose: ‘The FCA enables a fair and thriving financial services market for the good of consumers and the economy’. It also includes new guidelines on the narrative and tone of voice it uses.”

“The three paragraph ‘elevator pitch’ attempts to place economic growth squarely in its remit, alongside other legal duties around safeguarding investors and market integrity.”

“The FCA conducted both internal and external polling on the updated messaging, and is rolling out a ‘how we write’ guide with training for staff, according to a person familiar with the matter. It’s new tone of voice will be based on four principles: being clear and concise; relatable and engaging; measured and evidence-led; and positive and ambitious.”

WILDCARD

Why 94 is the new 54 for moguls

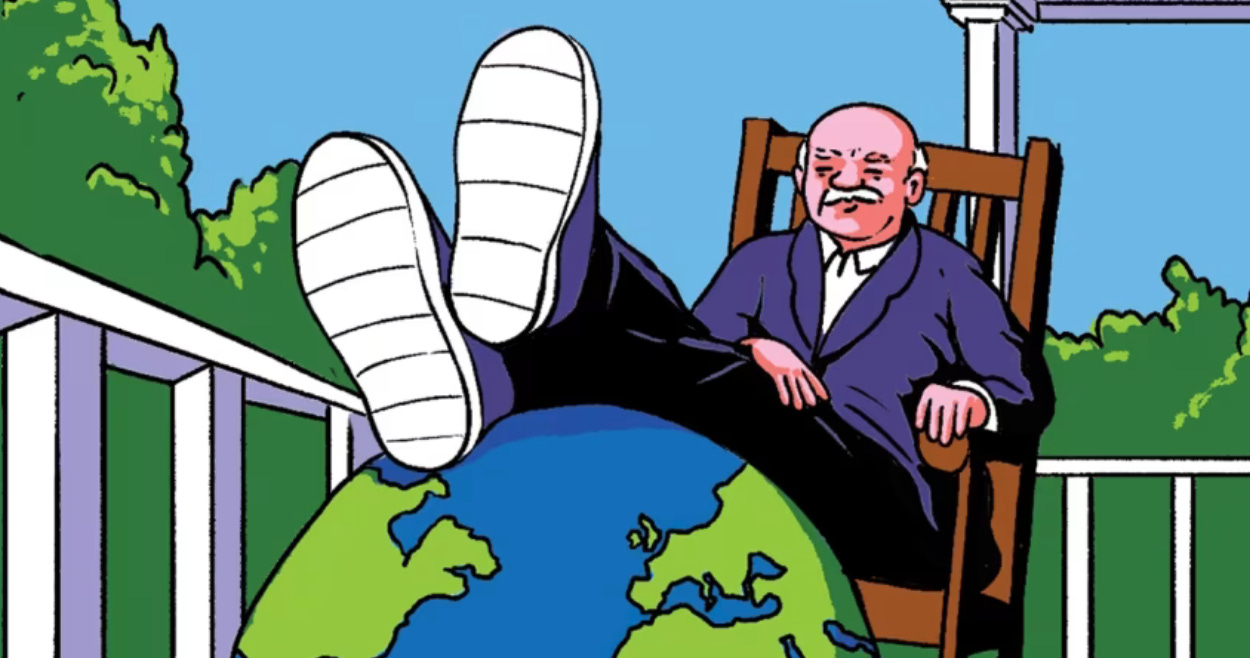

⑥ Moguls are the new royalty. In power and longevity.

“Moguls’ careers have grown to unprecedented lengths, thanks partly to innovations like stem-cell therapy and blood washing. This is helping to create a near-permanent power class of businesspeople who accompany us through our lives the way only a few royals did in the past.”

“Longevity is its own kind of power. When a newly elected head of government enters the global engine room, admitted on their temporary pass, they encounter a few dozen life members who have been there for decades, are planning ahead for decades more, and know exactly how each lever of power works. These men own the websites where most voters spend their waking hours and have the networks and capital to buy control of each new technological trend.”

“The current lot of tech tycoons, minted by their twenties, is set to be the longest-lasting in business history. Their main limitation — mortality — may eventually be lifted. They certainly have no intention of bowing out at the tender age of 94. British or French prime ministers will come and go like fruit flies in comparison.”

Off cuts

The stories that almost made this week’s newsletter.

FINANCIAL SERVICES

🇪🇺 Sibos 2025: Why Europe needs the integration of capital markets

📖 Aviva announces ‘new chapter’ in private markets investing

⚠️ Revolut, Barclays and Monzo top fraud complaints ranking

👩🏻⚖️ Deutsche Bank hit by London lawsuits from five former bankers

👋 Santander UK boss to exit ahead of TSB merger

TECHNOLOGY

🏗️ Sibos 2025: How to build the bank of tomorrow

🤖 Artificial intelligence: Citi trains, BoA bolsters, W1M says no

🏅 ECB picks digital euro service providers

📈 How London’s blockchain trading venue will reshape private markets

🪙 HSBC: Treasurers expect tokenisation to grow five-fold

MEDIA & MARKETING

🎬 OpenAI’s Sora video app is jaw-dropping (for better and worse)

🪦 Your content strategy just died. Here’s what comes next.

📲 How marketers can boost their executives’ presence on LinkedIn

📧 Six steps to crafting marketing emails your audience actually wants to read

🔎 10 reasons why answer engines are replacing search engines

The last word

⑦ Nobel laureate Jean Tirole on stablecoins:

“Stablecoins may dazzle as the latest financial fad. But they risk destabilising finance while enriching a few. The better course is to treat payments as a shared utility, not a speculative playground.”

Don’t settle for marketing.

Aspire to InMarketing.

Wishing you an interactive week,

P.S. I don’t like to brag but…I’ve found the greatest gadget of all time.