Issue № 136 | London, Sunday 18 May 2025

Read on to learn why:

① Brilliance lies in simplicity.

② Product and marketing should work together to turn feature into benefit.

③ The UK’s capital markets are still struggling.

④ The real appeal of stablecoins may be slightly mundane: speed of execution.

⑤ You should be yourself on social media. Everyone else is taken.

⑥ Too many men are still systematically undermining women.

⑦ Fund managers have to make a digital shift.

📸 But first, flashback to March when I told you that when your brand is getting in the way of your business, it’s time for a change. This week, Warner Bros. Discovery got the memo. It’s an improvement but one that has been met with ire.

What's new

This week, neo bank Monzo announced a significant product improvement, Finextra reports.

In short:

“Monzo has rolled out a new feature that allows customers to set a personal timeframe to cancel a mistaken bank transfer.”

“The new capability provides a customisable 10-60-second window that allows customers to cancel a bank transfer if a mistake is made, like adding an extra 'zero' to an amount, or selecting the wrong recipient. The tool also provides a moment of pause for someone to stop and think if they’re tricked into sending a fraudulent payment.”

“This comes as new data from the bank reveals that almost one in three Brits (30%) have either sent money to the wrong person or sent the wrong amount in the last year. Over three quarters of Brits who sent a wrong payment (78%) realised they’d made a payment error within just a minute of it happening.”

Why it matters

① When I first glanced at the headline, I marvelled at the complexity of Monzo’s work. How could they possibly have overcome the difficulty of getting all the correspondent banks to collaborate on a way to reverse a payment after it had been made? And then in hit me: they hadn’t. This is ‘cancelling’ a payment in the same way that Outlook now allows you to ‘unsend’ an email: it doesn’t send it in the first place. What they’re actually doing is delaying sending the payment/email to give their users a window of opportunity to change their mind. It’s quite brilliant in its simplicity.

It’s easy to argue that if people were a little more mindful of their payments - checking before paying, rather than afterwards - this is a feature that wouldn’t be needed. But it clearly is, and the data tells us as much. Monzo has identified a clear customer pain point and solved it with a smart feature. This story matters because it reminds us how the best product development addresses customer needs in the simplest way possible.

② And while Monzo won’t be getting any prizes for the complexity of their solution, it should perhaps for the way its product and marketing teams have collaborated. Their marketing people understand how to communicate an easy to implement feature. With product and marketing working together, they are delivering a tangible benefit: peace of mind. Yet another string to Monzo’s bow. Bravo!

What to do about it

Take action

Challenge your product and marketing teams this week. What technically simple features could your team deliver quickly and easily, then market most effectively?

And, if you need any further inspiration, watch Monzo’s CEO TS Anil discuss the company’s innovative approach to customer-centric banking.

Get help

Two ways I can help you: 1) hire me as a full-time member of your team; or 2) use InMarketing, an advisory service for senior leadership teams in finance and tech.

🔎 Audit 🧭 Strategy 🖋️ Positioning ✅ Planning 🤷🏻 Problem-solving ☎️ Counsel

Top stories

The other articles that are worthy of your time.

FINANCIAL SERVICES

Financial Conduct Authority plans to ‘put public back in IPO’

③ The UK’s capital markets are still struggling.

“After a torrid few years for the London Stock Exchange, the Financial Conduct Authority is opening new avenues to boost initial public offerings.”

“The proposed changes come amid mounting pressure from City firms to widen access to equity and bond markets for retail investors. Jim Moran, the FCA’s head of listing, said: ‘Our changes to prospectus rules will make it easier for companies to raise money on public markets and grow. We’re proposing to get rid of the six day rule, which added extra time to an IPO if it were offered to the public, to remove barriers for firms and open up participation in IPOs’.”

“LSEG data shows 88 companies – including tech darling Darktrace and Paddy Power owner Flutter – either delisted or transferred their primary listing away from London’s main market in 2024, with only 18 firms joining. In April 2025, takeovers outnumbered listings three to one after 15 firms made takeover bids and only four floated.”

TECHNOLOGY

Why financial giants are embracing stablecoins

④ The real appeal of stablecoins may be slightly mundane: speed of execution.

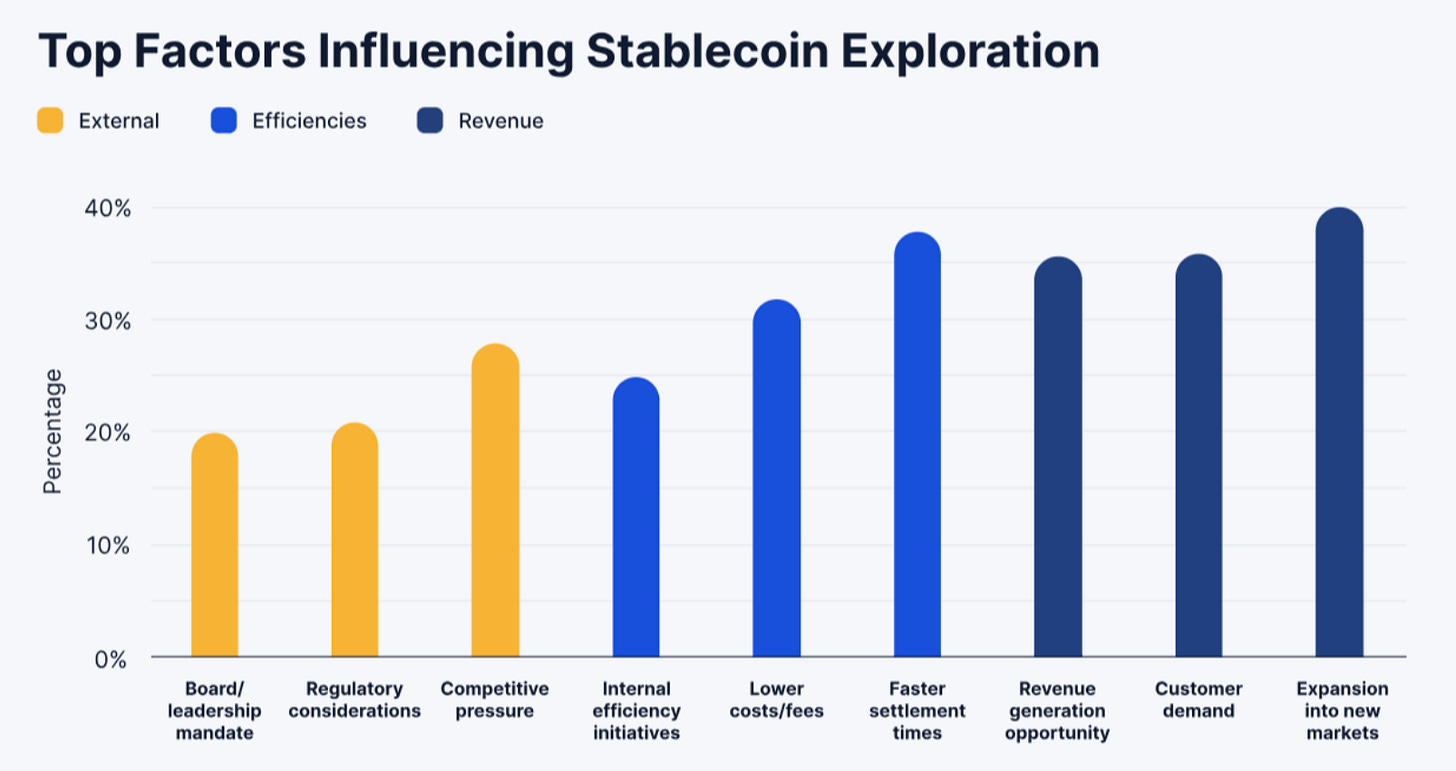

“A recent stablecoin survey of banks, fintechs, and crypto-native firms found that speed of execution was the single largest benefit of stablecoin payments, trumping cost savings. Forty-nine percent are already using stablecoins, with 41% planning or piloting their usage.”

“Revenue opportunities are the largest source of demand, often enabling expansion into new markets or to respond to customer demand.”

“The infrastructure for stablecoins needs to be five or ten times better than the infrastructure provided by large banks or credit card firms. Traditional payments take time to settle, providing an opportunity for recourse if something goes wrong, but stablecoins clear within a second on faster chains.”

MEDIA & MARKETING

Be human or be ignored — why authenticity matters

⑤ You should be yourself on social media. Everyone else is taken.

“A personal brand isn't just a logo or catchy tagline attached to your name - it’s the authentic expression of who you are, what you stand for, and the unique value you bring to others. It's the intersection of your genuine expertise and distinctive perspective that creates an impression in people’s minds when they encounter your work or hear your name."

How to build authenticity on social channels:

Get crystal clear about what you do

Show up until you can’t be ignored

Give first, ask later

"Your digital self can drive dividends beyond what you expect. Just be sure to be authentic."

WILDCARD

Almost 60% of UK women complain of financial ‘mansplaining’

⑥ Too many men are still systematically undermining women.

“Nearly 60 per cent of British women say they have been ‘mansplained’ on financial matters, leaving many to choose to actively avoid talking about money around men to limit chances of it happening.”

“Women still face the ‘ingrained assumption’ that they lack the same level of financial knowledge as men, while nearly two-thirds said they had been interrupted or talked over by a man who assumed they would not understand a personal finance issue. Of the 2,000 women interviewed, more than 25 per cent had been told how to budget by a man, while a third had been lectured to on ‘how investing works’, leaving many women feeling patronised and annoyed when it occurs.”

“British men ‘mansplain’ personal finance to women an average of 11 times a month according to the research, with husbands and partners being most likely to do so, closely followed by male colleagues.”

Off cuts

The stories that almost made this week’s newsletter.

FINANCIAL SERVICES

🇪🇺 Can Europe finally fix its capital markets?

👮🏻♂️ Bank of London under investigation by UK regulators

📲 FCA private messaging crackdown not expected to expand to wealth and asset management

TECHNOLOGY

🗓️ Why 2025 is set to be a pivotal year for Open Banking

⛓️ JPMorgan Chase settles transaction on public blockchain

🦾 BoE launches ‘AI Consortium’ as new external engagement platform

MEDIA & MARKETING

🤖 How to choose the right marketing AI tools for real business impact

🍰 The missing piece of your martech stack

📧 Email is the most misunderstood channel in your digital stack

The last word

⑦ Meagen Burnett on why fund managers have to make a digital shift:

“In a world where some people don’t feel confident engaging with traditional capital markets but do buy crypto, the fund management industry needs to do more to better appeal to digitally native younger generations.”

Don’t settle for marketing.

Aspire to InMarketing.

Wishing you an interactive week,

P.S. Did I tell you? I hired an intern this week. It was a total disaster.