Dotty dot com

Big, splashy, expensive stunts still have a role to play in marketing. Thank neuroscience.

Issue № 156 | London, Sunday 8 February 2026

Read on to learn why:

① Emotions are more powerful - and more common - than rational thought.

② Great marketing sits at the intersection of science and creativity.

③ Hong Kong’s stock market has China’s regulator to thank - and fear.

④ If you’re going to act like a bank, you need to be regulated like one.

⑤ AI is driving a fundamental shift in how people discover brands.

⑥ The key to long-term happiness is courage; feel the fear and do it anyway.

⑦ We are either on the verge of widespread AI adoption or a terrible crash.

📸 But first, flashback to last month when I told you why Anthropic’s marketing is the best in AI and Claude is my thought-partner of choice. This week, the world caught up: After Anthropic used the Super Bowl to launch a series of ads promising no ads on Claude, marketing gurus swooned, OpenAI CEO Sam Altman seethed and the FT showcased. Well played, Anthropic. Well played.

What's new

This week, the Crypto.com guy bought AI.com, Engadget reports.

In short:

“Crypto.com co-founder and CEO Kris Marszalek has launched a new AI agent platform under the brand AI.com, a domain he reportedly purchased for $70 million.”

“The new company claims this transaction is ‘believed to be the single largest domain purchase in history.’ There’s a chance there have been even larger deals that have not been disclosed. Historically, Cars.com has been cited as the most valuable domain name ever after financial statements tied to its acquisition in 2014 revealed the site was listed as an intangible asset worth $872.3 million.”

“[Marszalek] has reportedly already received interest from buyers for the domain, but believes AI.com will help the company build brand awareness and trust with customers. Cyrpto.com is no stranger to big, splashy marketing schemes. In 2021, it reached a $700 million multi-decade deal to rename Staples Center to the ‘Crypto.com Arena’.”

Why it matters

The website launch is being paired with a Super Bowl ad that will air later today:

When I launched a private wealth management platform, we spent months - and a substantial sum - agonising over its name then acquiring the corresponding .com domain. At the time, it felt like money well spent. But fast forward nearly a decade and - as you’ll read in Media & Marketing below - a catchy domain name is now far less important than whether your SEO and GEO are up to scratch. And yet…and yet, this story matters because - although little more than a very expensive stunt - it’s undeniable that AI.com’s launch is effective marketing. And that’s because we’re human and have pesky little organs called brains.

① Our prefrontal cortex tells us that website traffic is no longer a deciding factor in brand recognition, that any permutation of this domain name would have worked just as well. But, here’s the thing, while we’re rationalising how unnecessary this expensive stunt is, our nucleus accumbens is getting us all excited about this shiny, expensive new thing. We can’t help be at least curious about the “most expensive domain ever”. And then our hippocampus thanks us for making that domain name so easy to remember, while our amygdala starts prodding us with the fear of missing out on “getting our handle now”. Even though it’s not clear at all what benefit that may confer. Job done, Marketing. ✅

What to do about it

Take action

② I’m not suggesting you blow this year’s marketing budget on a domain name. I’m not even recommending you book expensive advertising slots. But I do think we should all remember that great marketing sits at the intersection of science and creativity, of brain and heart, of data and emotion. If we free ourselves just a little from the unrelenting demands from our CFOs that we prove attribution and quantify return on investment, we may just stumble on a big, audacious idea that we feel - but don’t know - will move the needle when it comes to brand recognition and reputation. Some ideas:

Corporate treasury management platform: Launch the ‘The CFO Sleep Score’. Give an Apple Watch to 500 CFOs on the condition they’ll measure and their sleep scores during month-end close. Publish the data as “The Treasury Insomnia Index” with industry breakdowns. Launch during earnings season when CFOs are most stressed. Offer free 30-day trials with a guarantee: “If we don’t improve your close process, we’ll pay for your next wellness retreat.”

RegTech compliance software: Build a physical installation in Canary Wharf showing every major regulatory fine from the past year as a brick wall—each brick represents £1M in fines, with company logos and violation details. Make it interactive: scan QR codes to see case studies of what went wrong.

B2B FX platform: Create a pop-up ‘FX Confessional Booth’ at fintech conferences and business districts. Business owners step in, input their typical FX transaction details anonymously, and instantly see how much they’re overpaying in spreads and fees versus your platform. Print them a ‘Hail Mary’ showing their annual hidden costs.

Get help

Two ways I can help you:

Tackle a specific challenge by retaining me in an advisory capacity or on a fractional basis.

Elevate all your marketing and communications by hiring me as a full-time member of your team.

Top stories

The other articles that are worthy of your time.

FINANCIAL SERVICES

Hong Kong is getting its financial mojo back

③ Hong Kong’s stock market has China’s regulator to thank - and fear.

“Last month Hong Kong equity sales increased more than five-fold compared with the same month a year ago, which was itself five times stronger than January 2024. Some 400 Chinese firms are seeking approval to sell shares. Hong Kong’s dealmakers have Beijing to thank. The China Securities Regulatory Commission has been quicker to approve secondary listings in which Chinese firms listed on mainland exchanges sell shares in Hong Kong. In 2026 these accounted for 24% of overall deal value.”

“This buffet of listings is coinciding with global investors’ growing appetite for Hong Kong shares. This diminished after America tightened rules on when American funds could invest in Chinese tech firms in the post-pandemic years. American firms did not want to be seen funding sensitive Chinese technology; Chinese ones worried that sudden American restrictions could provoke sell-offs. Such worries are slowly beginning to ease.

“A few things could still sour the mood. Investment banks, most of them Western, laid off staff during the quiet years and are struggling to hire them back. Chinese ones have been rushing through deals and drafting listing documents that Hong Kong’s local watchdog has found wanting. […] The CSRC is also politically sensitive and intensely scandal-prone. When the regulator appointed a new boss to its international division last year, approvals for Hong Kong listings stalled for two months.”

TECHNOLOGY

The stablecoin war: Wall Street vs crypto over the future of money

④ If you’re going to act like a bank, you need to be regulated like one.

“Crypto advocates say stablecoins are an improvement upon regular money because they are designed for a digital world and are both faster and easier to move. The staunchest want them to supplant existing money completely. Wall Street banks, however, see their expansion as a risky experiment that potentially threatens the stability of the financial system, and are aggressively pushing back. […] At the heart of the fight are the rules that govern the US crypto industry — and, in particular, the question of whether crypto companies should be allowed to pay interest to people who hold stablecoins on their platforms.”

“The banks say allowing crypto exchanges to pay interest means they are essentially acting like banks, and this poses risks to the wider financial system. Crypto companies say killing ‘rewards’ on stablecoins is a way for banks to remove competition.”

“While banks are pushing back on some aspects of stablecoins, they are simultaneously partnering with crypto companies to hedge their bets on a new, tokenised future. Almost all major banks and some asset managers are running projects experimenting with stablecoins or other forms of tokenised money such as putting customer deposits on the blockchain. Many believe that future stock, bond and fund markets will be tokenised, which could create a more central role for stablecoins in the financial system.”

MEDIA & MARKETING

AI search isn’t replacing SEO — it’s rewriting visibility

⑤ AI is driving a fundamental shift in how people discover brands.

“AI-powered search (Google AI overviews, ChatGPT, Perplexity) is changing where and how brands are discovered online. […] Here are six specific findings from [a new report]:

AI referral traffic is still small but meaningful: [There is] a shift in where discovery begins.

ChatGPT dominates AI referral sources: Brands optimising for visibility on ChatGPT could capture most early AI referrals.

Google’s AI overviews appear in over a quarter of searches: Brands need to optimise not just for rankings but to earn inclusion in those synthesised answer experiences.

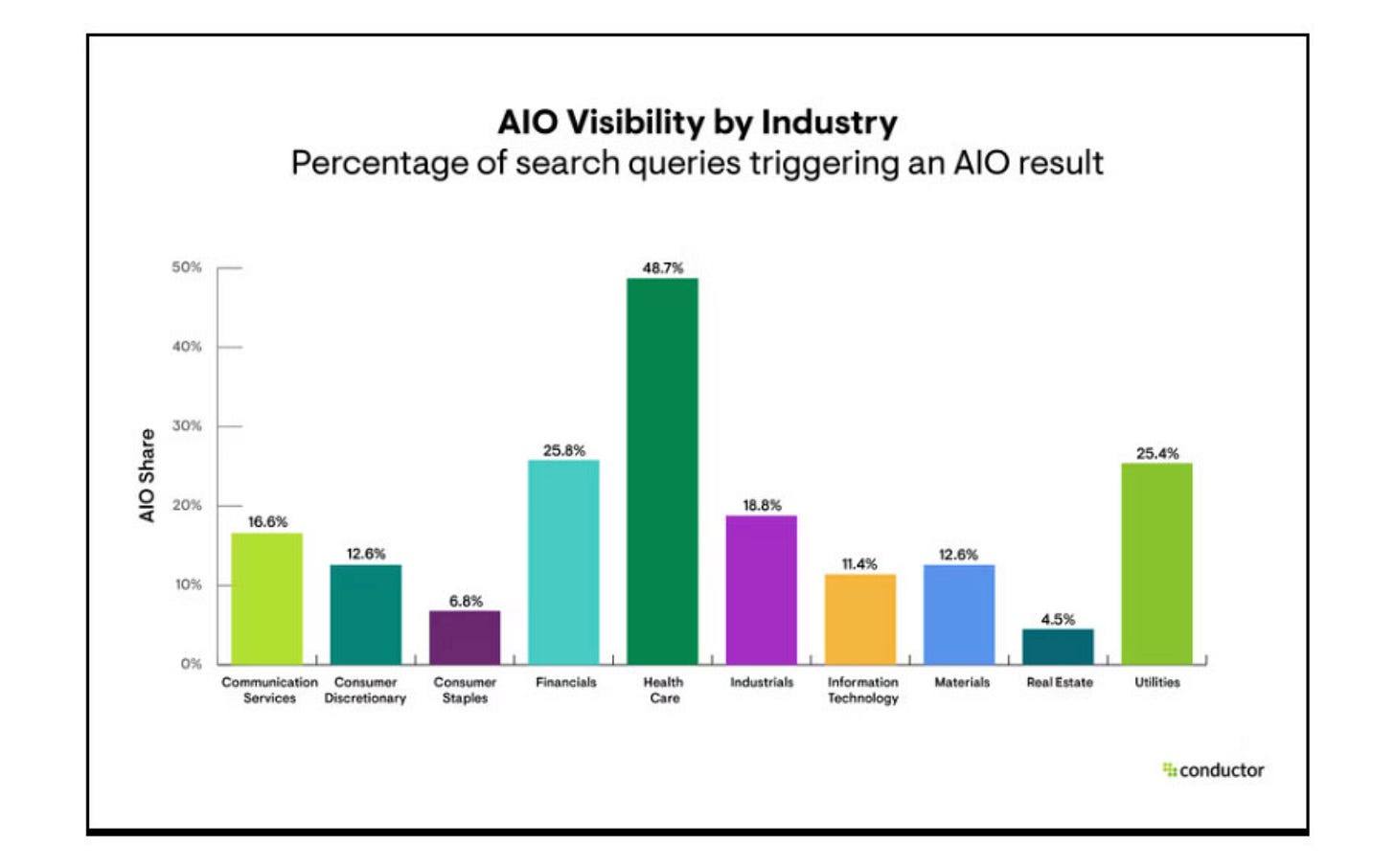

Visibility varies widely by industry: [Financials queries trigger nearly 26% AI overview results.] Query intent and content complexity drive how often AI systems synthesise responses for users.

AI search doesn’t replace SEO, it expands it: Organic search remains the backbone of most traffic, but brands that fail to win citations and mentions within AI answers risk missing out on early discovery moments before a user ever clicks.

Brand credibility is measured differently in AI: Brands need structured, high-quality content that AI systems can understand and confidently cite. This shifts performance measurement from clicks and rankings to shares of voice within AI answers.”

WILDCARD

More than half of UK workers stuck in jobs they don’t enjoy

⑥ The key to long-term happiness is courage; feel the fear and do it anyway.

“New research reveals that while many believe a dream job is achievable, only 12% say they’ve reached it. The study shows that while 54% believe a dream job is realistic and 58% say achieving it is important, most remain stuck.”

“More than half (53%) have stayed in a job they didn’t enjoy, often because they feared financial instability or doubted their ability to make a change. […] While 54% believe a dream job is realistic and 58% say achieving it is important, most remain stuck.”

“Four in 10 staying in jobs they don’t enjoy believe that leaving would make life harder.”

Off cuts

The stories that almost made this week’s newsletter.

FINANCIAL SERVICES

🌵 Private markets suffer ‘reality check’ as fundraising dries up

⚙️ How HSBC fashioned a $600bn debt machine

🫸🏻 Lloyds plans corporate banking push in strategy overhaul

🇬🇧 JP Morgan’s Chase sets sights on UK insurance market

💪🏻 Barclays and Natwest set for bidding war in race to beef up wealth arms

TECHNOLOGY

⚠️ AI is not the only threat menacing big tech

🇧🇷 Meet the fintech worth more than Revolut

✂️ Starling founder Anne Boden cuts stake in £4bn fintech

📉 PayPal appoints new CEO as results disappoint

⚛️ Atomic settlement swaps one risk for another, and banks aren’t ready

MEDIA & MARKETING

📰 Incisive Media launches account-based advertising for financial services sector

👏🏻 Investment Week appoints Cristian Angeloni as editor

🔎 AI search isn’t replacing SEO — it’s rewriting visibility

💵 OpenAI asks ChatGPT advertisers for $20k in commitments

🚓 French police raid X’s Paris office as UK investigation continues

The last word

⑦ Brooke Masters on why absolutely everyone is peddling an AI application:

“Big companies are under pressure to show results from AI after several years of corporate happy talk that has been long on enthusiasm but short on practical details. Despite widespread rollouts of large language models and thousands of pilot projects, 95 per cent of enterprises could show no positive financial impact last year, according to an MIT study.”

Don’t settle for marketing.

Aspire to InMarketing.

Wishing you an innovative week,

P.S. Saint Valentine’s Day is next Saturday. Are you ready?