Let’s get your Sunday started well, shall we? Here is the news likely to impact you, delivered with insight on why it matters and ideas on what to do about it.

📸 But first, with COP26 kicking off in Glasgow today, it seems apt to flashback to issue #36 in which we noted that the fight against climate change would be the driving force in finance for decades to come. This week, another confirmation: specialist financial communications and marketing agency (and erstwhile employer of mine) Cognito has launched a dedicated sustainability practice.

👉🏻 Now, read on to learn why:

① Jason Bourne says you’re a coward.

② Marketers shouldn’t rely on Compliance for integrity.

③ Caring for your clients is what will pay off in the long run.

④ The next challenge in ESG is measuring impact consistently.

⑤ Innovation for its own sake is doomed to fail.

⑥ CEOs need marketing expertise at the top table.

⑦ ‘Digital marketing’ should vanish from our vocabulary.

What's new?

① Brave CIA superspy Jason Bourne says you’re a coward if you don’t jump on board the crypto bandwagon with him.

Well, close enough. Actually, actor Matt Damon is the face of a costly new ad campaign from Crypto.com.

Fortune Favours the Brave | Crypto.com

In short:

“Produced by David Fincher, the 60-second commercial features Damon taking viewers on a historical journey of men and women who’ve made a difference in the world, in the hopes of inspiring people to ‘be their bravest selves’.”

“This marks the first global marketing push for Crypto.com, which has grown its user base about tenfold since last year amid rising interest in cryptocurrencies like Bitcoin. It will spend more than $100 million on the campaign.”

“'As our financial tools and platforms evolve, not only can we use them for good, like we are doing through this partnership that supports donations via crypto, but I am happy to do it with a like-minded partner that is committed to transforming lives through equity and access,‘ said Damon.”

Why does it matter?

There is a charitable angle to Damon’s involvement. He is working with Crypto.com to facilitate payments to his Water.Org charity. That’s commendable but it’s context that will be lost on 99% of the audience who will hear just one thing: you’re weak and cowardly if you don’t buy cryptocurrencies. And that’s disturbing.

In a week that also saw the news that

nearly half of advised UK investors are thinking about investing in cryptocurrencies;

brokers are making their apps game-like and “too easy” to use,

it’s easy to feel sympathy for the UK regulator that faces the Herculean task of countering all this marketing hype with facts and common sense. The FCA has just launched an £11 million education campaign targeting inexperienced investors called InvestSmart which includes taking to TikTok to try to counterbalance the so-called FinTok influencers. An uphill struggle if ever there was one.

② This all matters from a marketing perspective because it’s a reminder that, beyond our duty to abide by the regulator’s rules, we have a responsibility to act with integrity. In the words of C.S. Lewis, that means doing the right thing even when no one is watching. Creating financial promotions that are “fair, clear and not misleading” will ensure they’re signed off by our Compliance teams but that’s a low bar. We need to do more.

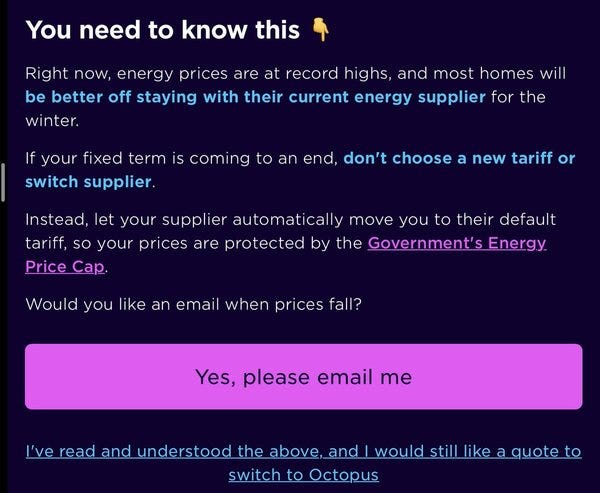

Consider for the sake of contrast how energy company Octopus is communicating at the moment:

Certainly can't accuse Octopus Energy of going for the hard sell https://t.co/fRvyOizioF

What's next?

Take action

③ Does your business always put the best-interests of your clients before profit? Show that Octopus Energy message to your Head of Marketing this week as a reminder that, whenever she or he is tempted (and, believe me, we marketers all are from time to time) to ramp up the hype just a little too much, dialling it down and focusing on caring for your clients is what will pay off in the long run.

Get help

I’m looking for a full-time, in-house role but in the post-Covid age of depleted marketing budgets and remote teams with skills gaps, many organisations need marketing and communications support that’s agile, flexible, and risk free. That’s why I founded WhatsNext Partners.

Whether it be as a permanent member of your team or with on demand support, just hit ‘reply’ to let me know if you need my help.

Share

Can I ask you a favour? If you found this post useful or know someone who would, please share it with your professional network. It really helps me to grow the readership.

What else?

Three other articles that are worthy of your time.

FINANCE

Navigating the thicket of ESG metrics

④ The next challenge in ESG is measuring impact consistently.

Amy Clarke, Tribe Impact Capital. Source: The Financial Times, 25 October 2021

“A lack of standards in the measurement and reporting of ESG products and funds can leave investors confused. And when it comes to impact investments, capturing the right data takes time, effort and, often, a hands-on approach. The problem is not a lack of data but an oversupply of tools and frameworks.”

“The EU has introduced rules to establish what can be considered a sustainable investment fund, setting tough disclosure requirements for asset managers that want to market a fund as a sustainable product. One of the most significant developments in standards could be the launch next month by the International Financial Reporting Standards Foundation of the International Sustainability Standards Board, which will set standardised ESG reporting metrics.”

“To gain insights into how investments portfolios are contributing more broadly to people and the planet, the Impact Management Project, a global consensus-building forum, suggests using the UN Sustainable Development Goals as a framework.”

TECHNOLOGY

Why ‘boring’ financial innovation matters

⑤ Innovation for its own sake is doomed to fail. Customers come first.

Source: Raconteur, 28 October 2021

“Lofty predictions about technologies such as artificial intelligence, blockchain and big data analytics have been echoing around conference halls worldwide in recent years. But some recent innovations, while seemingly prosaic by comparison, are proving vital to many customers in need right now.”

“Metro Bank, boldly ended the status quo back in 2010 by opening on Sundays. To protect against fraud, it also introduced the novel idea of photographing new customers when they visited a branch to open an account. Such innovations, while seemingly mundane compared with the promise of AI, have benefited both institution and customer in equal measure.”

“Many digital advances made in financial services during the pandemic have not been earth-shattering ideas. Rather, they have been necessary solutions at a time of crisis. In putting human need before technological ambition, several businesses accepted any ensuing loss of profitability because it was the right thing to do from an ethical standpoint.”

MEDIA & MARKETING

How to change the CEO-CMO relationship from rivals to teammates

⑥ CEOs need marketing expertise at the top table.

Source: Marketing Insider Group, 28 October 2021

I’d challenge the clickbait headline because I have yet to meet a CEO who wants to fight with his or her CMO - the real issue is lack of understanding - but this piece does contain some great insight:

“Marketers need to focus on the customer’s needs and interests 100% of the time. When CEOs ask for remedial tasks like rebranding and excessive paid social media ads, they stray further and further away from what actually works.”

“One of the issues between CEO and CMO relationships is the lack of pushback. Rather than blindly do what the CEO wants to make them happy, the CMO needs to find research that either supports the new effort or takes it off the table. CMO tenure is at the lowest point of the last decade. 80% of CEOs credit this short tenure to CMO failure, when in reality it’s a disconnect between what success really looks like.”

“Align company goals with marketing goals. When all the company’s organizational branches are working towards a common goal, the pay off is exponential. When the CEO is on board with CMO ideas, these ideas have a fighting chance at paying off.”

Well said

Jemima Kelly on cryptocurrencies and the metaverse:

Jemima Kelly. Source: The Financial Times, 27 October 2021

“As far as I’m concerned, the hypocritical fantasy that underpins crypto also lies at the heart of the metaverse. This isn’t about building a decentralised paradise where everyone can prosper and live in harmony; this is about making a small group of people rich.”

One more thing...

Source: LinkedIn

⑦ Louis Grenier is a marketer I’ve stolen from in these pages before. He’s as smart as a whip and, by his own description, “fights marketing bullshit with radical differentiation”. He wrote a great LinkedIn post about why the term “digital marketing” should vanish from our vocabulary. Amen, Louis.

(In short: marketing fundamentals are not going to change anytime soon, because humans are not going to change anytime soon. And what’s not digital these days anyway?)

Off cuts

The stories that almost made this week’s newsletter.

MONDAY

🥊 ‘Ruthless’ bitcoin ETF fee war looms after Van Eck filing

🎗 BNPL consumers ‘support credit checks’

🤑 MasterCard to help banks offer crypto credit card rewards

TUESDAY

🤝 Klarna and Stripe announce ‘buy now, pay later’ partnership

📲 New neobank Pennyworth launches

👨🏻💻 How to choose a content marketing platform for your business

WEDNESDAY

💳 Visa boasts it is fuelling BNPL around the world

🇨🇭 UBS starts digital wealth bank in U.S. to rival Wall Street

😲 Monzo reportedly raising £300m funding

THURSDAY

☑︎ 11 reasons why you should choose HubSpot over WordPress

💰 Wealthtech player Tifin raises $47m

🎰 Traders bet ethereum will benefit from ETF boost in 2022 and guess what happened the very next day…

FRIDAY

💸 Ether cryptocurrency hits all-time high

👑 Coutts client assets climb £1bn on surging inflows

⛽️ European Investment Bank will no longer finance oil and gas

Don’t settle for marketing.

Aspire to InMarketing: innovate, interact, influence.

Have a productive week.