Act fast

Damning associations demand your brand's immediate reaction.

Issue № 61 | London, Sunday 30 October 2022

Read on to learn why:

① We all have a moral obligation to draw a line on hatred.

② Even the strongest brands can be tarnished by association with toxic partners.

③ IMTW must be read by someone at the financial regulator.

④ For now, regulation and reputational risk protect finance from tech giants.

⑤ Twitter will rely less on advertising and turn its attention to payments instead.

⑥ It’s time to let go of much of what used to define the workplace.

⑦ Vowels deserve our protection.

What's new

After dithering for what felt like months (it was 10 days), Adidas finally reacted to its partner Kanye West’s anti-Semitism this week.

In short:

“Adidas has cut ties with rapper and fashion designer Kanye West and condemned his anti-Semitic remarks, in a move that is expected to halve the sportswear maker’s profits this year. The decision comes after West, said that he could ‘say anti-Semitic things and Adidas can’t drop me’.”

“The world’s second-largest sportswear maker expects to take an up to €250mn hit to net profit this year, with its shares trading down almost 6 per cent on Tuesday. Last week, it warned on profits for the second time in three months, saying net income was expected to reach €500mn in 2022.”

“Adidas put its longstanding tie-up with West under review earlier this month after ‘efforts to privately resolve the situation’.”

Why it matters

Have you noticed how quiet sponsors of this year’s dubiously-located World Cup are being? At too many brands, someone in marketing renewed the multi-million dollar sponsorship deal months ago because ‘hey, it’s the World Cup’ and they’re only now giving proper thought to what it means to be associated with a reprehensible regime. The Kanye West issue is an order of magnitude worse than that.

① Whether you enjoy his music, admire his shoe designs, or sympathise with his mental health problems, West - indeed anyone with an audience - can’t be allowed to normalise hatred and discrimination. As Scott Galloway wrote this week, we have a “moral obligation to draw a line.”

Outrageous claims seem less outrageous the more they’re repeated. Which is why repeating them must have severe and immediate consequences. And you might think that, given the complexity involved in untangling what was doubtless a complex commercial relationship, 10 days is close enough to immediate. But it wasn’t immediate enough to protect the brand from damage that was avoidable.

② Even the strongest of brands can be tarnished by association with toxic partners. But if you’re - let’s say - a luxury car company whose products used to be favoured by a fascist Führer or, in the case of the clumsy shoemaker, a consumer brand with a murky history tied to Germany’s national socialists, you should be finely attuned to anything that might put the spotlight on your past. By failing to act swiftly, Adidas attracted the ire of the Central Council of Jews which lambasted the company. “I know sneakers are a big business, but on an issue of anti-Semitism this cannot be an obstacle for doing the right thing,” said the council’s president Josef Schuster, calling the issue “a litmus test for the company”. Quoted in the Financial Times, Schuster also pointed to Adidas’s historic responsibility as the German company had been “enmeshed with the Nazi regime and benefited from it”.

This wince-inducing reputational damage would have been avoided if Adidas had skipped attempts to “privately resolve the situation” in favour of decisive action.

What to do about it

Take action

I would never encourage knee-jerkism, wokeness or that most awful of modern phenomenons, ‘cancel culture’. But, as I hope is already crystal clear to you, that’s not what we’re talking about here.

There are some issues - you can likely count them on one hand - that don’t require nuanced debate, consideration or risk/reward analysis. It’s binary: they’re just plain wrong and demand your immediate reaction: speak up and cut ties.

Identify these issues, right them down if you feel the need to, and ensure your senior team feels empowered to take steps the moment they occur. Inaction is action too - and occasionally it’s the most damaging action you could take.

Get help

Visit InMarketing, my resource library for leaders in finance or technology who want to innovate, interact and influence.

Join my InMarketing Twitter community, where you can ask questions of me but also your fellow senior marketing practitioners.

Share

If you found this useful or know someone who would, please share it. It would really help me to grow the community of regular IMTW readers.

Top stories

The other articles that are worthy of your time.

FINANCE

FCA cracks down on greenwashing

③ IMTW must be read by someone at the financial regulator.

“The Financial Conduct Authority has proposed a package of new measures to clamp down on greenwashing. Measures include investment product sustainability labels and restrictions on how terms like ‘ESG’, ‘green’ or ‘sustainable’ can be used.”

“The measures are among several potential new rules which the regulator hopes will protect consumers and improve trust in sustainable investment products.”

“There has been growth in the number of investment products marketed as ‘green’ or making wider sustainability claims. Exaggerated, misleading or unsubstantiated claims about ESG credentials damage confidence in these products.”

TECHNOLOGY

Is Big Tech a threat to financial services?

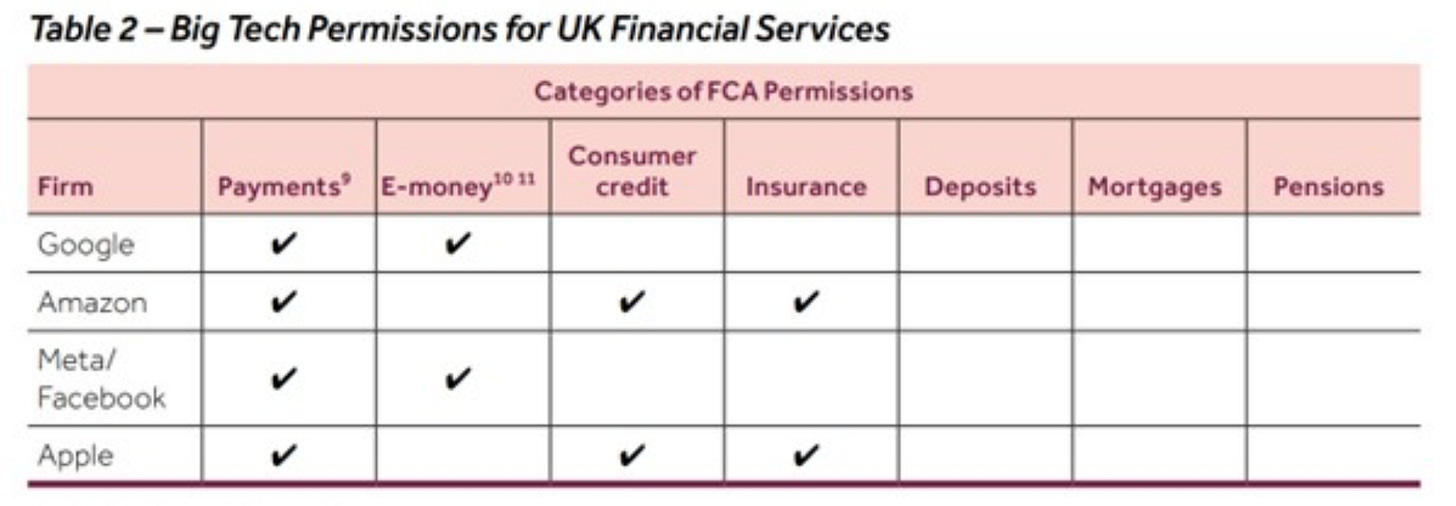

④ Onerous regulation as well as high reputational and political risk form the ever-shallower moat protecting traditional finance firms from the tech giants.

“In the short-term, it is likely that Big Tech firms would look to enter the financial services market through partnerships with incumbents.

But, the FCA believes, in the medium‑to‑longer term, Big Tech firms may choose to enter financial services more directly by attempting to capture more of the value chain – either through acquisitions, or by bringing value chain activities in-house.”

“A report published in March by CBI Insights suggested one can see the beginnings of what the ‘Bank of Amazon’ could look like — a variety of key financial services products which support Amazon participants first, and enable them to buy, sell, and transact more easily than any other platform. The report warned that this should worry traditional incumbents.”

“If Big Tech does decide to enter financial services, the impacts on existing companies could be disastrous. On the other hand, these companies could bring some much-needed innovation into the sector. Either way, if businesses do not have a clear digital strategy, this news should act as an important wake up call to get one in place.”

MEDIA & MARKETING

What will Elon Musk do with Twitter?

⑤ Twitter will rely less on advertising and turn its attention to payments instead.

“[Musk] wants to build a WeChat-style superapp, tweeting: ‘Buying Twitter is an accelerant to creating X, the everything app’. These are apps that typically allow users to message, shop, send payments or order taxis all in one place — and are popular in China where antitrust laws are less stringent than the US.”

“Changpeng Zhao, chief executive of Binance, one of the equity investors in the deal, said that he hoped to help Musk ‘realise a new vision for Twitter’, including broadening ‘the use and adoption of crypto and blockchain technology’ — signalling that crypto might be part of Musk’s payments plans.”

“Musk has suggested that the company will shift away from relying so heavily on advertising in future — down to 45 per cent of revenues by 2028 from around 90 per cent in 2021.”

WILDCARD

The archaeology of the office

⑥ It’s time to let go of much of what used to define the workplace.

“The most obvious artefact is the landline phone, a reminder of the days when mobility meant being able to stand up and keep talking. Long after people have junked them in their personal lives - less than 15% of Americans aged between 25 and 34 had one at home in the second half of 2021 - landline phones survive in offices.”

“Flipboard charts have suffered a swifter reverse. These objects signal a particular type of torture—people physically crowded together into a room while an idiot sketches a quadrant with a marker pen and points meaningfully to the top-right-hand corner. The idiot is still making quadrants but is now much more likely to use a slide deck. The crowd is still being tortured but is now much more likely to be watching on a screen. The office still has flipboards, but they are stowed in corners and their topmost pages are slowly yellowing.”

“If your office still uses internal mail, with those special envelopes that have people’s names crossed out as they wend their way round an organisation, you are in a corporate period drama. But most offices still retain clues to the historical importance of paper. Photocopiers, scanners, shredders, guillotines and unfeasibly large staplers are echoes of a not-too-distant time when physical documents were a vital currency, when people assembled in a single room and shared ideas on pieces of paper.”

Off cuts

The stories that almost made this week’s newsletter.

FINANCE

🛝 UBS profits slide as rich clients turn cautious on turbulent markets

🇨🇭 Credit Suisse to slash 9,000 jobs on £3.5 billion quarterly loss

💡 Barclays joins Illuminate Financial fintech startup fund

🌏 Wealthy Asians invest in digital assets

🌟 Palace intrigue at UBS pits CEO against a rising star

TECHNOLOGY

🇪🇺 EU’s proposed ‘instant payments’ could super-charge open banking

🏦 BIS and central banks complete CBDC pilot

🤑 Crypto-friendly Rishi Sunak means a major boost for Bitcoin Britain

🇸🇬 Singapore lays down the law for crypto trading and stablecoins

🦬 Swift accepts community request to delay ISO 20022 migration

MEDIA & MARKETING

📉 Why marketing spend is even more important during a recession

🥇 Five predictions for B2B CMOs to win in 2023

😔 How weak leadership cratered Twitter’s morale

🪦 Who killed the social media ad boom?

🍎 Apple VP Greg Joswiak says ‘metaverse’ is a word he will never use

The last word

⑦ Pilita Clark on rebranding:

“There is absolutely nothing modern or hip about stripping perfectly serviceable vowels from names.”

Don’t settle for marketing.

Strive for InMarketing: innovate, interact, influence.

Wishing you a productive week,

P.S. I wouldn’t even try to summarise it for you but don’t miss Matt Levine’s tome on crypto (where it came from, what it all means, and why it still matters).